Overview

Pay equity and transparency issues are of increasing concern to employers and employees alike, and with good reason. Just about every state in the country has passed legislation to complement the Equal Pay Act mandating equal pay for equal work and most states have pay equity and transparency laws that are more far-reaching than federal law. Many states, including California, New York and New Jersey, have enacted robust pay equality statutes covering all protected classes of employees and other states like Massachusetts, Colorado and Oregon have unique safe-harbor provisions for employers who conduct pay equity audits.

High stakes equal pay litigation has exploded across industries and multi-million-dollar class action settlements are reported weekly. Activist shareholder groups are demanding that companies conduct pay audits to ensure employees are being paid fairly and are complying with these new laws.

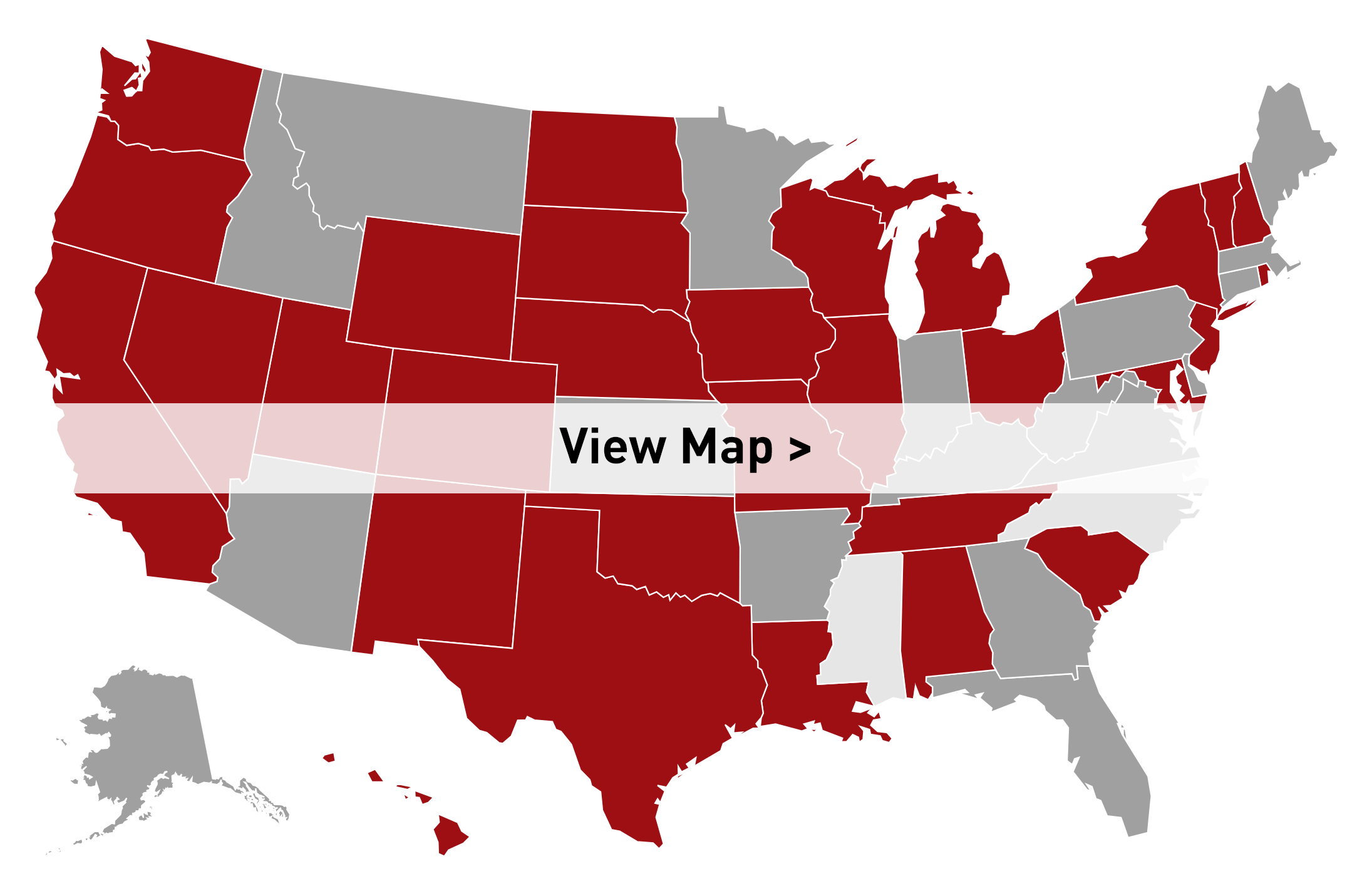

To help employers understand and respond to these developments, Fisher Phillips’ Pay Equity and Transparency Interactive Map allows visitors to explore various pay equity laws by simply hovering on each state.

The Fisher Phillips Pay Equity and Transparency Practice Group works with you to help navigate the challenging demands of equal pay laws. As one of the first law firms to establish a dedicated pay equity practice, our lawyers across the country know the ins and outs of the evolving state laws and can help you:

- Evaluate your compensation data to identify pay disparities,

- Implement pay practices designed to comply with the increasing demands of new laws and regulations, and

- Defend any claims of unlawful pay practices that land on your desk.

HOW DOES FISHER PHILLIPS ASSIST EMPLOYERS IN NAVIGATING PAY EQUITY AND TRANSPARENCY COMPLEXITIES?

Proactive Audit

We can conduct a privileged audit of your pay practices, an indispensable first step in any compliance effort. To help you prepare for and comply with federal and state pay equality and transparency requirements, we’ll undertake a careful three-step process. We’ll review your compensation policies and pay determinations to ensure your organizational decisions are properly documented. We’ll identify differences in pay across gender and other protected classifications. And we’ll help you justify any pay disparities based on legitimate factors, such as location, education, or training, or make adjustments as necessary.

Prevention & Compliance

Pay equity and transparency laws are complex, exacting, and vary from state to state. They also carry very substantial potential penalties. We take a holistic approach to pay equity and transparency issues. We review policies, applications, and other critical documents to mitigate risk and ensure compliance with new and evolving pay equity and transparency laws. We train management level employees, human resources staff, and compliance experts who are responsible for determining and monitoring employee compensation and ensure they have a complete understanding of pay equality and the mandates of the Equal Pay Act and applicable state and local laws.

Defense of Legal Actions

Pay equity and transparency lawsuits are time-consuming and costly. What’s more, the federal Equal Pay Act includes a procedure to provide notice and conditionally certify claims. There is no doubt that the number of equal pay collective actions will continue to grow exponentially– just as wage and hour claims have done over the past several decades. Knowing the many sensitivities involved, our deep bench of accomplished class and collective litigators stands ready to aggressively and strategically respond to any litigation and enforcement actions.

HOW WE CAN HELP

- You’re an established company whose former high-ranking executive has filed a complaint alleging gender discrimination, retaliation and wrongful termination.

We can help you determine the merit of the claim and investigate if – and why – compensation disparities exist. Exactly what constitutes a legally permissible justification for differences in pay varies under federal and state laws. Questions about differences in pay often begin innocently enough but can quickly spiral into damaging confrontations unless they are carefully managed and defended at the outset. - You run a business and some of your employees are upset over differing salaries and how overtime is determined.

There are legal reasons for pay disparities, including seniority; merit; quantity or quality of production, sales, or revenue; or job-related education, training, or experience. The Equal Pay Act requires men and women in the same workplace to receive equal pay for equal or substantially similar work. We can conduct a pay equity audit to determine when and how to remedy any potentially problematic disparities. - You’re an established company and have used an applicant’s salary history to set their pay.

This all-too-common business practice has led to costly class action lawsuits against employers. We’ll work with you to develop an action plan now to assist you in complying with state and federal laws.

Key Contacts

-

- Kathleen McLeod Caminiti

- Partner and Co-Chair, Wage and Hour Practice Group

-

- Lonnie D. Giamela

- Partner

- See all