Washington lawmakers were busy this year, and a wave of new laws will have a major impact on the workplace. Employers must be aware of significant workplace laws taking effect within the next year, including 11 new laws that kicked in this month. Nearly all add more compliance requirements to your plate, and the changes even ramp up the penalties for failures to comply. Here’s a quick guide to help you keep track of it all and prepare for the changes.

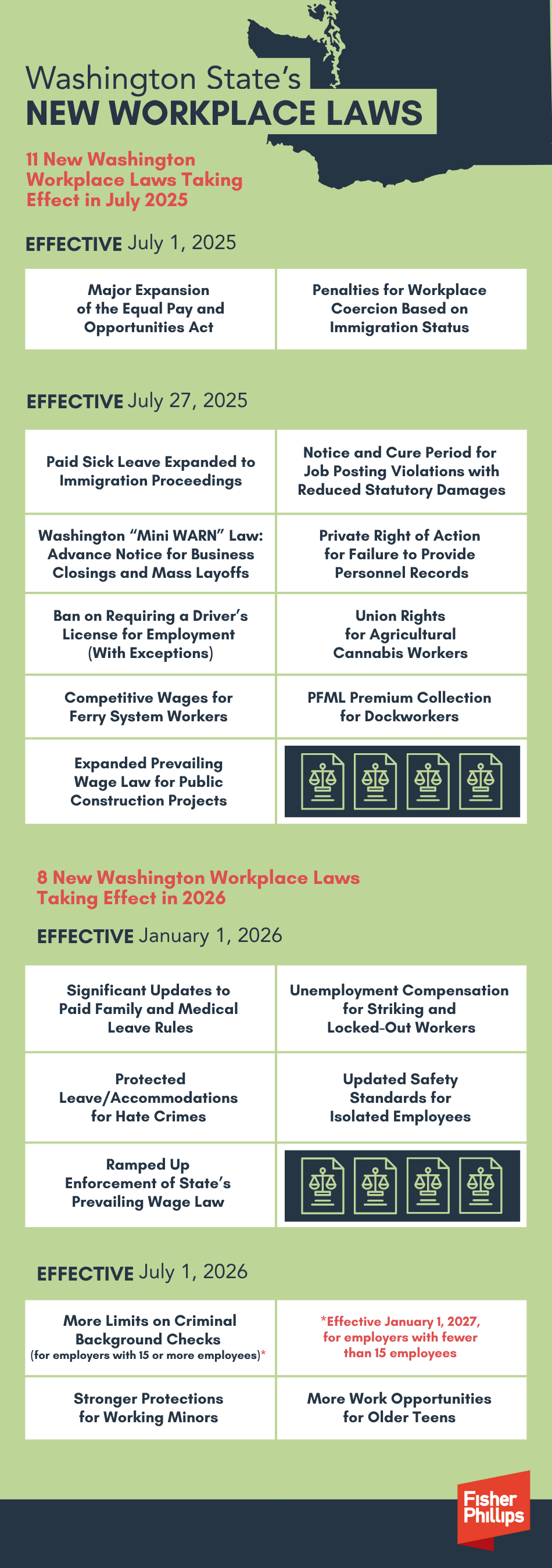

11 New Washington Workplace Laws Taking Effect in July 2025

Effective July 1, 2025

- Major Expansion of the Equal Pay and Opportunities Act (HB 1905 - 2024). Washington’s pay transparency law adds age, sex, marital status, sexual orientation, race, creed, color, national origin, citizenship or immigration status, and honorably discharged veteran or military status. It also includes the presence of sensory, mental, or physical disability or the use of a trained dog guide or service animal by a person with a disability to the gender-based protections. The legislature also made important amendments to the EPOA’s job posting rules this year, as discussed below.

- Penalties for Workplace Coercion Based on Immigration Status (SB 5104). Employers may now face civil penalties – up to $10,000 per violation for repeat offenders – for exploiting employees based on their (or their family member’s) immigration status to cover up wage payment and labor violations.

Effective July 27, 2025

- Paid Sick Leave Expanded to Immigration Proceedings (HB 1875). Covered reasons under Washington’s paid sick leave law (which first took effect in 2018) now include time off to prepare for, or participate in, any judicial or administrative immigration proceeding involving the employee or employee's family member. Employers may require certain types of verification for absences exceeding three days.

- Notice and Cure Period for Job Posting Violations with Reduced Statutory Damages (SB 5408). During a two-year period beginning July 27, 2025, and ending July 27, 2027, employers that fail to meet the pay scale/salary range and benefits disclosure requirements for job postings may avoid liability for a violation if they correct the posting within five business days of receiving written notice of the violation. SB 5408 includes other updates that ease some of the compliance burden on employers and limit their liability under EPOA. Read more here: Washington Lawmakers Cut Employers a Break for Job Posting Noncompliance: 7 Things You Should Do.

- Washington “Mini WARN” Law: Advance Notice for Business Closings and Mass Layoffs (HB SB 5525). Washington now imposes its own requirements for “business closings” or “mass layoffs” in addition to the federal Worker Adjustment and Retraining Notification (WARN) Act. The Washington law has some key differences, including:

- The state law applies to employers with 50 or more employees, compared to the WARN Act’s 100-employee threshold.

- A “mass layoff” involves employment loss for 50 or more employees, but there is no explicit requirement that the employment loss be at a single site of employment.

- Employers may not include employees currently on Washington paid family and medical leave in an order of a mass layoff.

- A failure to give the requisite notice means a civil penalty of $500 for each day of the violation.

- Private Right of Action for Failure to Provide Personnel Records (HB 1308). Significantly changing Washington law, employers must now provide a full copy of an employee’s personnel file free of charge within 21 days of receiving a written request from a current or former employee or their designate. Failing to do so may result in statutory damages (up to $1,000 for each violation in some circumstances), and reasonable attorneys’ fees and costs. Employers that fail to provide written reasons for an employee’s termination also risk statutory penalties. The new law also expanded the definition of what is considered a personnel file, including “leave and accommodation” records. Learn more here: Washington Ramps Up Personnel File Rules and the Consequences for Noncompliance: 5 Employer Takeaways + 5 Steps to Take Now.

- Ban on Requiring a Driver’s License for Employment (With Exceptions) (SB 5501). Employers cannot require a valid driver’s license as a condition of employment unless driving is an essential job function or is related to a legitimate business purpose for a position. Each violation can potentially result in liability for actual or statutory damages (plus interest), civil penalties, and more.

- Union Rights for Agricultural Cannabis Workers (HB 1141). Certain cannabis workers will have state-recognized collective bargaining rights, similar to those of public employees.

- Competitive Wages for Ferry System Workers (HB 1264). Salaries of ferry system collective bargaining units are now more competitive and may help improve the state’s ferry system.

- PFML Premium Collection for Dockworkers (SB 5191). The state’s Paid Family and Medical Leave law now covers employees of “representatives for employers of dockworkers who normally work for several employers in the same industry interchangeably through a collectively bargained agreement.”

- Expanded Prevailing Wage Law for Public Construction Projects (HB 1821). The law expands the definition of “interested party” – a person who may file a prevailing wage complaint – to include joint labor-management cooperation committees and Taft-Harley trusts. It also requires Washington’s Labor and Industries to provide copies of an employer’s certified payroll records to an interested party upon request. Additional changes to the state’s prevailing wage law will take effect in 2026, as discussed below.

8 New Washington Workplace Laws Taking Effect in 2026

Effective January 1, 2026

- Significant Updates to Paid Family and Medical Leave Rules (HB 1213). Paid Family and Medical Leave (PFML), which rolled out in 2020, will expand in various ways. Now employees will qualify for job protection upon returning from protected leave after just 180 days of employment (whereas the current rules require at least 12 months of employment and at least 1,250 hours worked during the one-year period preceding the leave). These protection rules will start applying to employers with at least 25 employees in 2026 (whereas the current threshold is 50 employees). That employee threshold will drop again to 15 employees in 2027 and to just eight employees in 2028. The new law also seeks to mitigate against so called “leave stacking” of job-protected leave under the federal Family and Medical Leave Act (FMLA) and the state’s PFML. Current PFML does not give employers a mechanism to require that PFML run concurrent with FMLA. The amendment provides a new procedure for employers to count FMLA leave towards WA PFML for purposes of the job protections. Employers should check back closer to the end of 2025 for guidance on the notice requirements to avail themselves of this new option.

- Unemployment Compensation for Striking and Locked-Out Workers (SB 5041). The new law will expand eligibility for unemployment compensation benefits during labor disputes. Learn more here: Oregon and Washington Will Allow Unemployment Benefits for Striking Employees Starting in 2026: Key Takeaways for Employers.

- Protected Leave/Accommodations for Hate Crimes (SB 5101). Starting in 2026, Washington’s existing paid sick leave law and its domestic violence leave law will include “safety accommodation” time off for victims of hate crimes. A “hate crime” means the commission (or the attempted or alleged commission) of an offense under RCW 9A.36.080, including offenses committed through online communication. Both laws will prohibit retaliation or discrimination based on this new protected status.

- Updated Safety Standards for Isolated Employees (HB 1524). The standards apply to hotels, motels, retail, and security guard entities, as well as property services contractors, that employ at least one “isolated” employee, such as certain janitors, security guards, housekeepers, or room service attendants. Updates include expanding what qualifies as “isolated” employee conditions; adding training, recordkeeping, and functional requirements related to panic buttons; and imposing new civil penalties (up to $1,000 for each willful violation and up to $10,00 for each repeat willful violation).

- Ramped Up Enforcement of State’s Prevailing Wage Law (HB 2136 - 2024). The state will boost accountability for violators of the state’s prevailing wage law on public construction projects – including through penalties, sanctions, and debarment. Former Gov. Jay Inslee signed this bill into law last year (with a delayed effective date of January 1, 2026).

Effective July 1, 2026

- More Limits on Criminal Background Checks (HB 1747). Since 2018, Washington has been a “ban the box” state, prohibiting questions to job applicants about arrests or convictions before determining whether they are otherwise qualified for a position. The law will be significantly expanded – effective July 1, 2026, for employers with 15 or more employees, and effective January 1, 2027, for employers with fewer than 15 employees – to prohibit any “tangible adverse employment actions” that are (1) based on an applicant’s or employee’s arrest record or juvenile conviction record (subject to limited exceptions), or (2) solely based on an applicant’s or employee’s adult conviction record, unless the employer has a legitimate business reason for taking such action and complies with certain written notice requirements and procedures. Learn more here: Washington Further Limits Criminal Background Checks in the Workplace: An Employer’s Guide and Compliance Action Plan.

- Stronger Protections for Working Minors (HB 1644). A new law will, among other things, increase penalties for child labor law violations and, in certain circumstances, require the state to revoke an employer’s minor permit for at least 12 months.

- More Work Opportunities for Older Teens (HB 1121). Minors who are 16- or 17-years old and enrolled in a bona fide college program or in a qualifying career and technical education program will be allowed to work more hours during the school year.

Conclusion

For more information, contact your Fisher Phillips attorney, the author of this Insight, or any attorney in our Seattle office. Make sure you are subscribed to Fisher Phillips’ Insight System to receive the most up-to-date information directly to your inbox.