Did you keep up with all the workplace law updates in 2025? Take our quiz to see if you can score a perfect 10 or need to do some catch-up work. After jotting down your answers, use the answer key at the end (no peeking!) to grade yourself – you’ll either earn instant bragging rights or win “most improved” by reading the FP insights linked for anything that had you stumped.

1. 🗺️ IMMIGRATION – Federal immigration officials clarified key details about the new $100K H-1B fee that rolled out in September. Which of the following petitions (assuming they are filed on or after September 21, 2025) would require the sponsoring employer to pay the new fee? Choose up to four.

a. Petitions for new hires outside of the US

b. Petitions for recent international graduates in F-1 status applying for a change to H-1B

c. Petitions for current H-1B holders applying for an amendment, change of employer, or extension

d. Petitions for aliens in the US, if the petition requests consular notification, port of entry notification, or pre-flight inspection

2. 🤖 ARTIFICIAL INTELLIGENCE – Which of the following statements about the current state of federal artificial intelligence policy and regulation are true? Choose up to four.

a. President Trump revoked a Biden-era AI policy aimed at ensuring safe and ethical AI deployment.

b. The Trump administration rolled out a new AI action plan focused on innovation, infrastructure, and international diplomacy and security.

c. Congress passed comprehensive AI legislation that will regulate everything from workplace bias and privacy rights to deepfakes and content labeling, starting in 2027.

d. President Trump signed a sweeping new executive order directing the federal government to file lawsuits and cut funding for states that regulate AI.

3. ⚖️ LITIGATION – We recently published our FP SCOTUS predictions for Trump v. Slaughter, a critical pending case that could impact employers for years to come. How do our attorneys expect the Supreme Court to decide the case in 2026?

a. The Court will uphold statutory removal protections for FTC members and rule that federal courts may prevent a person’s removal from public office.

b. The Court will uphold statutory removal protections for FTC members but rule that federal courts may not prevent a person’s removal from public office.

c. The Court will strike down the statutory removal protections for FTC members, and it is clear that the Court will overturn its 1935 unanimous decision upholding those protections.

d. The Court will strike down the statutory removal protections for FTC members, but it is less clear whether the Court will overturn or narrow its 1935 unanimous decision upholding those protections.

4. 🪧LABOR RELATIONS – The National Labor Relations Board is currently suing two states over new laws they enacted this year to expand state power over private-sector labor matters. What are the two states?

a. California and Washington

b. California and New York

c. New York and Washington

d. Massachusetts and Washington

5. ⚠️DEI and EEO – The Trump administration dramatically shifted federal policy on how existing federal civil rights laws apply to diversity, equity, and inclusion programs. Directives issued throughout 2025 impact:

a. Federal contractors and subcontractors

b. Recipients of federal funding

c. Private businesses and private schools

d. All of the above

6. 🦺 WORKPLACE SAFETY – During the Biden era, OSHA proposed the first-ever national heat standard. Under Trump’s OSHA, that proposed rule…

a. …has been scrapped entirely.

b. …was finalized earlier this year with immediate effect.

c. …was finalized earlier this year, but it does not take effect until the middle of 2026.

d. …is still on the table and expected to be finalized in some form in 2026.

7. ⚕️EMPLOYEE BENEFITS AND TAX – The Affordable Care Act was a hot topic in 2025. Which of the following are true? Choose up to four.

a. The Supreme Court issued a decision in June allowing enforcement of the ACA’s preventive-care mandates.

b. The “Big Beautiful Bill” repealed the ACA’s employer shared responsibility provisions effective January 1, 2026.

c. The “Big Beautiful Bill” will allow individuals who are enrolled in bronze or catastrophic plans available through the ACA Marketplace to contribute to health savings accounts, starting in 2026.

d. The ACA’s enhanced premium tax credits set to expire at year’s end was largely to blame for the federal government’s longest-ever shutdown this year.

8. 🔏PRIVACY AND CYBER – Which of the following states enacted brand new data protection laws this year that will take effect January 1, 2026?

a. Indiana

b. Kentucky

c. Missouri

d. All of the above

9. 🤫EMPLOYEE DEFECTION AND TRADE SECRETS – The Federal Trade Commission announced in September that it had warned certain employers about their use of noncompete agreements and other restrictive covenants. Which industry did the FTC target with these warning letters?

a. Healthcare

b. Manufacturing

c. Tech

d. Finance

10. 💲PAY EQUITY AND TRANSPARENCY – The Trump administration dropped federal pay equity initiatives. Which of the following should employers expect in 2026?

a. An avalanche of pay equity and pay transparency litigation

b. A rise in internal pay equity audits

c. More state and local pay-data reporting obligations

d. All of the above

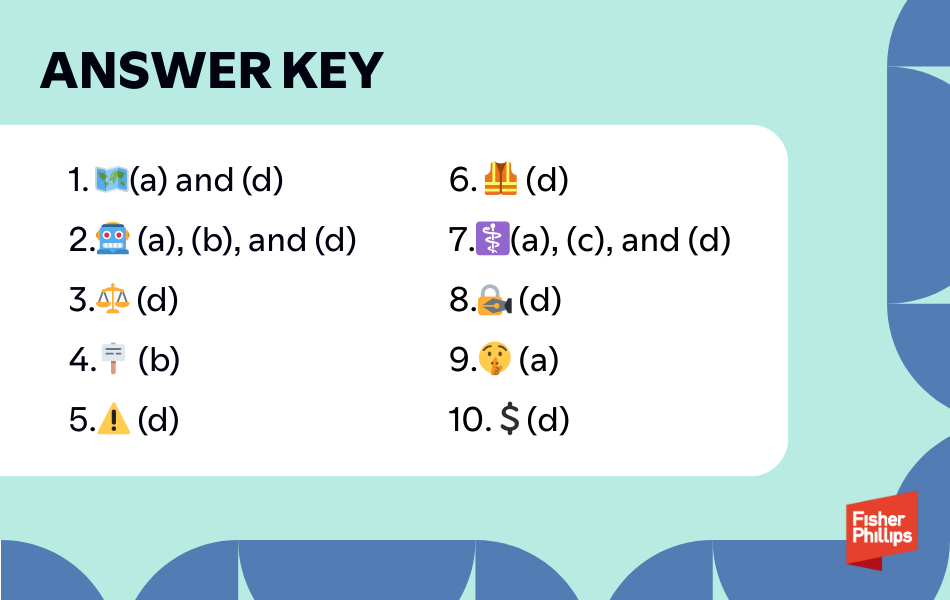

Scroll down to find the Answer Key and Further Reading…

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Further Reading

For any question you missed or are curious to learn more about, you can click on the corresponding link below to get caught up.

1. 🗺️ Federal immigration officials issued guidance in October to clarify key details about the new $100K H-1B fee. If you have questions, contact any attorney in our Immigration Practice Group.

2. 🤖 In January, President Trump revoked a Biden-era AI policy aimed at ensuring safe and ethical AI deployment. In July, the administration rolled out a new AI action plan focused on innovation, infrastructure, and international diplomacy and security. Congress did not pass comprehensive AI regulation. Much to the contrary, Trump signed a sweeping new executive order on Dec. 11 directing the federal government to file lawsuits and cut funding for states that regulate AI. If you have questions, contact any attorney in our AI, Data, and Analytics Practice Group.

3. ⚖️ Our FP attorneys predict SCOTUS will strike down the statutory removal protections for FTC members, but hold varying opinions over whether the Court will narrow Humphrey’s Executor v. United States or fully overturn it. We will continue to monitor developments related to this case and provide an update when SCOTUS issues an opinion, so make sure you subscribe to Fisher Phillips’ Insight System to get the most up-to-date information.

4. 🪧 The National Labor Relations Board is currently suing California and New York over new laws they enacted this year to expand state power over private-sector labor matters. If you have questions, contact any attorney in our Labor Relations Practice Group.

5. ⚠️ The Trump administration’s dramatic shift on how existing federal civil rights laws apply to DEI programs has impacted federal contractors and subcontractors, recipients of federal funding, private businesses, and private schools. If you have questions, contact any attorney in our DEI and EEO Compliance Practice Group.

6. 🦺 Many expect that OSHA will scale back the proposed heat stress rule, but the agency has signaled that it is on board with advancing some form of heat illness protection. OSHA is now carefully reviewing and responding to comments submitted during the rulemaking phase. If you have questions, contact any attorney in our Workplace Safety Practice Group.

7. ⚕️The Supreme Court issued a decision in June allowing enforcement of the ACA’s preventive-care mandates. The “Big Beautiful Bill” did not repeal the ACA’s employer shared responsibility provisions, but it does expand HSA eligibility, starting in 2026, to individuals enrolled in bronze or catastrophic plans available through the ACA Marketplace. Last but not least, the ACA’s enhanced premium tax credits set to expire at year’s end was largely to blame for the federal government’s longest-ever shutdown this year. If you have questions, contact any attorney in our Employee Benefits and Tax Practice Group.

8. 🔏 Indiana, Kentucky, and Missouri each enacted brand new data protection laws this year that will take effect January 1, 2026. If you have questions, contact any attorney in our Privacy and Cyber Practice Group.

9. 🤫 The Federal Trade Commission announced in September that it had warned several large healthcare employers and staffing firms about their use of noncompete agreements and other restrictive covenants. If you have questions, contact any attorney in our Employee Defection and Trade Secrets Practice Group or any attorney on our Staffing Industry Team or our Healthcare Industry Team.

10. 💲While the Trump administration dropped federal pay equity initiatives, employers should expect 2026 to bring an avalanche of pay equity and pay transparency litigation, a rise in internal pay equity audits, and more state and local pay-data reporting obligations. Check out the Pay Equity and Transparency section for our FP Forecast 2026 to learn more. If you have questions, contact any attorney in our Pay Equity and Transparency Practice Group.