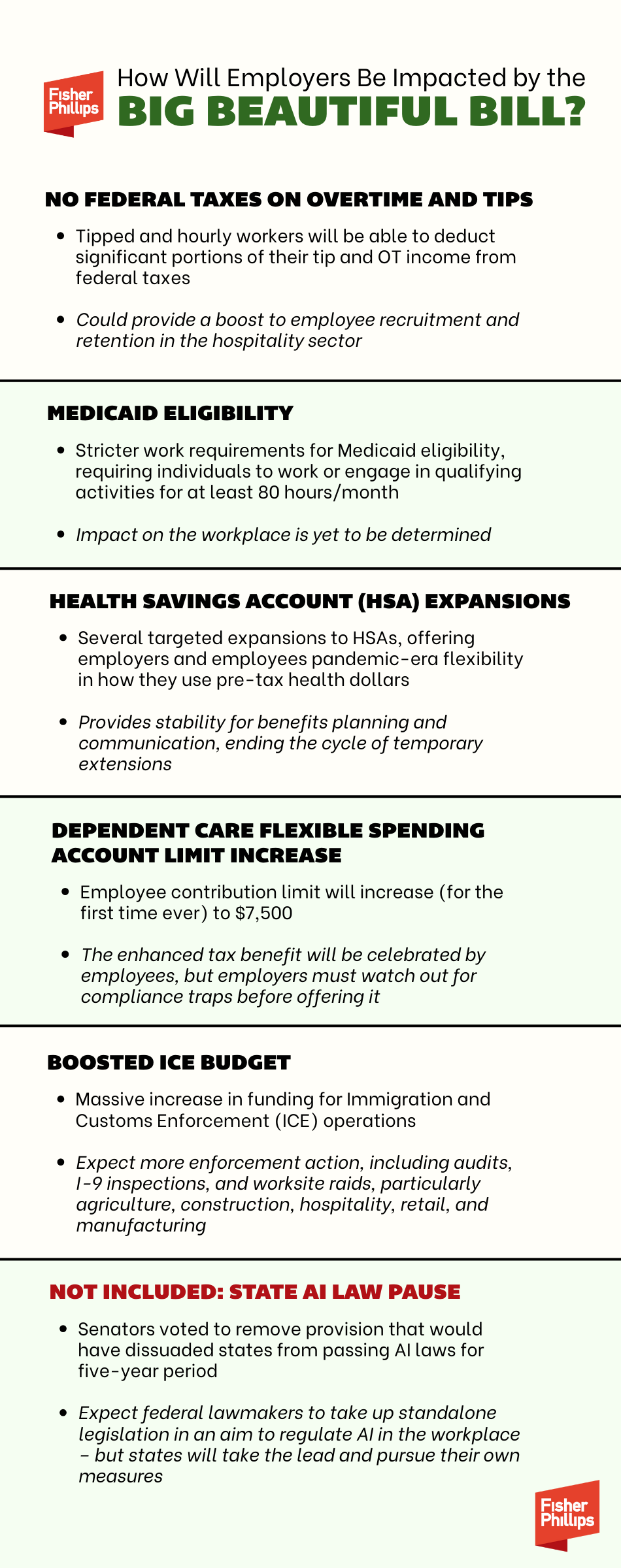

Don’t have the energy to slog through the 1,127 (or so) pages of the legislative text, amendments, and explanatory materials that comprise the final version of the “Big Beautiful Bill” to see how it impacts labor and employment law? Don’t worry – the Government Affairs team at Fisher Phillips has your back. Here’s an overview of the ways that the workplace will be impacted by the final budget bill signed by President Trump on July 4.

|

No Federal Tax on Overtime and Tips Tipped and hourly workers will be able to deduct significant portions of their tip and overtime income from federal taxes, potentially making hospitality and similar jobs more attractive. |

Details

- Individuals must earn $150,000 or less in 2025 to eligible; for couples, the combined income limit is $300,000 (this threshold will be adjusted for inflation in future years)

- For tip deductions, employees must work in occupations where receiving tips is customary, such as servers, bartenders, hotel staff, hairstylists, etc. (The Treasury Department will publish a comprehensive list of eligible tipped occupations by October 2)

- Only cash tips (including those charged and those received under tip-sharing) and tips reported to employers for payroll tax purposes are eligible

- The maximum deduction for tip income is $25,000 per year

- For overtime deductions, they must receive OT pay as defined by the Fair Labor Standards Act (FLSA) (pay for hours worked beyond 40 in a workweek at a premium rate), and the deduction only applies to the premium portion of OT pay (the amount above the regular hourly rate)

- The maximum deduction for OT income is $12,500 per year (up to $25,000 if married filing jointly)

- These exemptions will only apply in from TY2025 to TY2028 and will need to be extended by Congress to continue. [Ed. Note: The IRS issued guidance on Nov. 5 that gives employers penalty relief for the 2025 tax year for certain failures related to new information reporting requirements added by the Big Beautiful Bill, such as failures to separately report amounts designated as cash tips or qualified overtime compensation.]

Impact on Employers

- These deductions could provide a boost to employee recruitment and retention in the hospitality sector.

- Employers will need to adjust payroll systems to accurately track and separately report these amounts on W-2 forms, increasing administrative complexity for payroll and HR departments.

|

Medicaid Eligibility While not a direct workplace regulation, the bill introduces stricter work requirements for Medicaid eligibility, requiring individuals to work or engage in qualifying activities for at least 80 hours per month. |

Details

- Adults aged 19 to 64 in the Medicaid expansion group must complete at least 80 hours per month of work, job training, education, or approved community service to maintain eligibility (unless they fall under an exemption, such having dependent children, qualifying medical conditions, etc.)

- States must verify compliance with work requirements at application and at least every six months

Impact on Employers

- This could affect employee health coverage and increase HR involvement in verifying or documenting employees' work hours for those relying on Medicaid.

- Some observers believe this requirement will lead to a growth in the number of people seeking employment, especially at low-skill and lower-paying jobs.

- Others believe the cuts to Medicaid and other social programs could lead to reduced employee health coverage, especially among lower-wage workers, potentially increasing absenteeism or turnover due to loss of benefits.

|

Health Savings Account (HSA) Expansions The bill introduces several targeted expansions to Health Savings Accounts (HSAs), offering employers and employees pandemic-era flexibility in how they use pre-tax health dollars. |

Details

- The final law permanently allows telehealth coverage before deductibles for HSA-compatible plans, permits HSA funds to pay for direct primary care, and expands HSA eligibility to individuals enrolled in health plans through the Affordable Care Act’s Marketplace

- High-deductible health plans (HDHPs) with HSAs may continue to cover telehealth and other remote care services before the deductible is met, making pandemic-era relief permanent (the safe harbor otherwise would have expired at the end of 2024)

- Beginning in 2026, HSA funds can be used to pay for certain direct primary care (DPC) arrangements – up to $150 per month for individuals and $300 per month for families

- Beginning in 2026, individuals enrolled in bronze and catastrophic plans through the ACA Marketplace will become eligible to contribute to HSAs

Impact on Employers

- Employers can offer or promote HDHPs with robust telehealth and DPC options, making benefits packages more attractive and flexible.

- The permanent telehealth provision provides stability for benefits planning and communication, ending the cycle of temporary extensions.

- More employees – including those on ACA bronze and catastrophic plans – can participate in HSAs, increasing the reach of tax-advantaged health savings.

- Employers interested in direct primary care can now facilitate pre-tax payment for these services, supporting employee access to affordable, relationship-based care.

|

Dependent Care Flexible Spending Account (FSA) Contribution Limit Increase The dependent care FSA contribution limit will increase for the first time since 1986 (aside from the COVID-era increase $10,500 that was only applicable for 2021.) |

Details

- Starting in 2026, the dependent care FSA contribution limit will increase from $5,000 to $7,500

- This will be a welcome change for employees as childcare and elder care expenses continue to skyrocket

- Just like the current limit, the new limit is not indexed to inflation

Impact on Employers

- Employers will need to amend their cafeteria plan documents (and other materials, such as summary benefit materials) to offer the higher limit.

- Employers considering whether to adopt the new $7,500 limit should confirm that they can still satisfy the nondiscrimination testing requirements under Section 129 of the Internal Revenue Code. Note that many employers already experience difficulty passing these tests, which are designed to ensure that dependent care FSA benefits are not skewed in favor of higher-paid employees.

|

Boosted ICE Budget = Increased Immigration Enforcement The bill provides a massive increase in funding for Immigration and Customs Enforcement (ICE) and Border Protection (CBP) operations, dramatically expanding enforcement resources and capabilities. |

Details

- ICE’s annual budget is tripled to nearly $30 billion for enforcement and deportation operations, with a total of about $170 billion allocated over the next decade for immigration enforcement and border security.

- That money will partially be used to hire 10,000 new ICE employees over the next five years, aiming to achieve the stated goal of doubling the current workforce.

- As a result, we should see an increase in mass deportations, expanded detention infrastructure, and crippling new financial barriers to legal immigration processes.

Impact on Employers

- ICE is expected to ramp up workplace activities in the near future, including audits, I-9 inspections, and worksite raids, particularly in industries such as agriculture, construction, hospitality, retail, and manufacturing.

- Familiarize yourself with your rights and responsibilities should you face an enforcement action, and take proactive steps to take to minimize the chances of one occurring at your workplace. Read our Employer’s Playbook For ICE Audits And Workplace Raids for more information.

- Have clear procedures in place to address potential enforcement actions.

- Conduct an immigration health check of your compliance program.

|

Provisions Not Included in the Final Bill As FP has previously noted, Senators voted overwhelmingly in the days leading up to final passage to drop the proposed pause on state AI laws that would have dissuaded state lawmakers from regulating artificial intelligence at the local level for the next five years. You can read more about this failed proposal and steps employers should take here. |

Conclusion

We will continue to monitor developments related to all aspects of workplace law. Make sure you are subscribed to Fisher Phillips’ Insight System to get the most up-to-date information. If you have questions, contact your Fisher Phillips attorney, the authors of this Insight, any attorney on our Government Relations team, our Hospitality Industry team, or our Employee Benefits and Tax team.