Overview

Wage and hour laws present many challenges to businesses ranging from increasingly complex compliance demands to the risk of high stakes litigation. With the U.S. Department of Labor vigorously enforcing the Fair Labor Standards Act (FLSA), state and local laws and regulations constantly expanding employees’ rights, and wage and hour class and collective action cases proliferating across the country, compliance is more critical than ever. Businesses, particularly those with nationwide operations, must navigate a minefield of differing laws while achieving operational goals within budget constraints.

Fisher Phillips’ Wage and Hour Practice Group advises and defends employers in all aspects of wage hour law, including pay practices and policies, worker classification (e.g., exempt or non-exempt, employee or independent contractor), and all analysis and steps critical to determining compliance – or costly noncompliance. With in-depth knowledge of all relevant federal laws, including the FLSA and its state counterparts, we work with employers across the country to identify and address risky pay practices to minimize any exposure and, when necessary, defend them in litigation and investigations.

Bringing decades of experience to bear, our seasoned lawyers devise creative and effective solutions to wage hour challenges. We coordinate with each of the firm’s industry teams, enabling us to bring invaluable practical knowledge to each client’s situation. Our experience spans nearly every sector, including retail, automotive, manufacturing, hospitality, and financial services.

PREVENTION, COMPLIANCE AND TRAINING

Because it’s best to prevent violations and claims before they occur, we proactively advise businesses on the many layers of federal, state, and local laws impacting pay practices. Our attorneys will work with your legal and human resources teams to examine wage and hour procedures and make any adjustments – before a lawsuit or investigation hits.

Our team can help you:

- Develop compensation plans that properly balance applicable legal requirements, employee relations concerns, and business goals

- Direct privileged self-audits to identify problem areas and implement necessary changes affecting employee classification, compensation, timekeeping, and recordkeeping

- Conduct due diligence reviews

- Evaluate whether employees are exempt from minimum wage and overtime requirements

- Determine whether employees are compensated properly

- Train front-line managers regarding hours worked issues and avoiding managing through payroll

We tailor our approach to each client’s needs, offering flat prices for many projects and a phased approach that increases efficiency and decreases fees by leveraging our vast wage hour experience coupled with knowledge gained at each stage.

GOVERNMENT INVESTIGATIONS

Investigations brought by the U.S. Department of Labor’s Wage and Hour Division and similar state agencies across the country frequently result in hefty fines. With a proven record of success representing employers in these matters, we stress rapid, effective planning at the beginning of each investigation, which helps clients highlight their wage hour compliance and avoid costly mistakes. We work with you throughout the process, realistically evaluating your situation, helping you to understand and carry out the many steps you can take to limit the investigation’s scope and reach while minimizing or eliminating the risk of major exposure.

LITIGATION

Fisher Phillips’ seasoned litigators defend wage and hour lawsuits in court and administrative agencies across the country, including class and collective actions. We have successfully litigated thousands of complex cases across the full spectrum of industries and employers in the U.S., defending employers against claims involving:

- “Off-the-clock,” “rounding” and overtime claims by non-exempt employees

- Misclassification

- Minimum wage violations, including reimbursement claims

- Uncompensated meal and rest breaks

- Miscalculated commissions and bonuses

- Prevailing wages

- Payroll deductions

- Recordkeeping

We are skilled at countering plaintiff’s lawyers seeking to leverage the harsh web of potential penalties, which can swiftly multiply against you. Our team creates strategies to decisively resolve cases while minimizing your out-of-pocket costs.

Partnering with Blue J Legal, we are helping build AI technology to analyze fact patterns and relevant precedent to predict likely outcomes. We have developed a proprietary variable model that harnesses data early on to project costs and potential exposure and aid in settlement and mediation discussions.

STATE LAWS

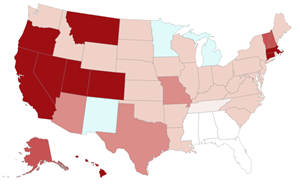

Virtually every state has wage and hour laws designed to protect employees’ rights. These individual mandates are often quite exacting and carry significant penalties for noncompliance. They also expose unwary employers to large adverse judgments.

California, for example, has perhaps the toughest wage and hour laws in the nation, with its Labor Code and Wage Orders often going far beyond the requirements of federal law and Private Attorneys General Act (PAGA) suits posing many substantive and procedural obstacles. New York and New Jersey have distinct wage notice requirements and escalated damages provisions, Nevada has unique overtime requirements, and many states have imposed overtime and minimum pay standards. The maze becomes more intricate nearly every year, particularly for businesses operating across multiple states.

With skilled wage hour lawyers across the county, Fisher Phillips' Wage and Hour Practice Group has commanding knowledge of the requirements and nuances of state wage hour laws. We are prepared to advise clients on compliance requirements and to defend the most complex wage hour matters. Our lawyers keep abreast of recent developments and know how to combat plaintiffs’ lawyers who are adept at twisting the thicket of rules and penalties against you.

HOW WE CAN HELP

- You’re creating a new position in your company and are unsure whether you can pay by salary, or whether it should be a non-exempt (hourly) position.

We can help you evaluate the position under state and federal law to ensure the position is properly classified. This helps your company avoid what can be costly litigation. Misclassification cases, often brought on a class basis, can be very expensive to defend. We can also help you audit current jobs to ensure employees are properly classified and paid properly. - The US DOL (or parallel state agency) has just notified you of an audit. You are unsure if this is a random audit or the result of a complaint.

We regularly assist employers in determining how best to respond to requests for information in an audit. We can help you navigate the investigation and help you and your company know what to expect. If violations are found, we can help you negotiate the resolution and design communications to employees to constructively address the issues. - You’ve just been served with a class and collective action lawsuit claiming that you have not paid hundreds of employees properly.

On a daily basis, members of the WHPG defend employers in class and collective action cases across the country. Our experience means you don’t have to pay us to learn the law or how to defend against the claims asserted. These cases often become complicated quickly, so it is imperative to start developing a strategic response as soon as you have notice of the claim.

Key Contacts

-

- Kathleen McLeod Caminiti

- Partner and Co-Chair, Wage and Hour Practice Group

-

- J. Hagood Tighe

- Partner and Co-Chair, Wage and Hour Practice Group

- See all