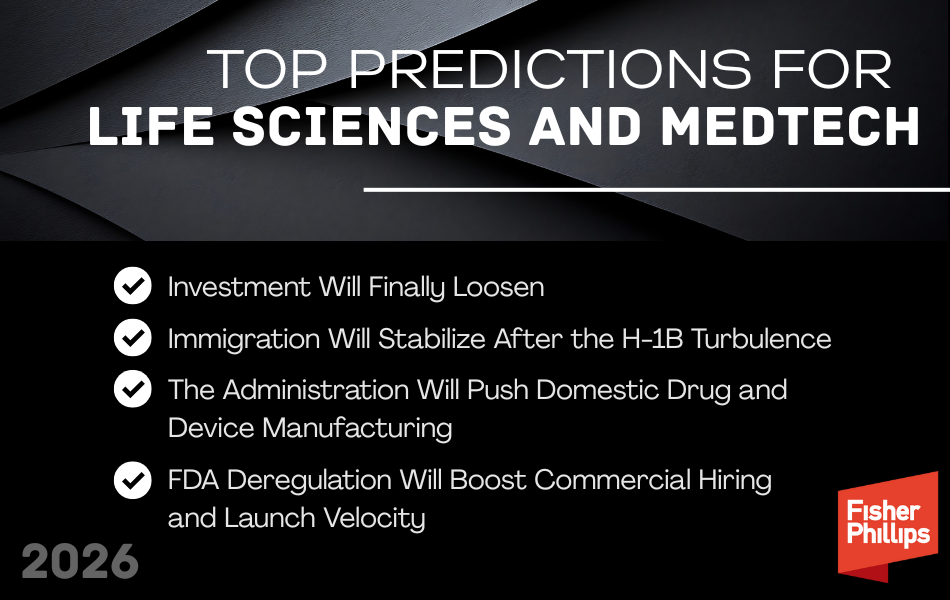

FP’s Top 2026 Predictions for Life Sciences and MedTech

Insights

1.12.26

Our Life Sciences and MedTech thought leaders have pulled together their top predictions for the new year so that employers can get a running start to 2026. If you want more, register for our FP Forecast 2026 Webinar here.

Investment Will Finally Loosen

After two years of political and economic whiplash, private equity and venture capital are poised to open the tap again in 2026 and diversify their investments. Funds have been sitting on record dry powder, waiting for stability and clearer signals on rates, regulation, and market direction. With the plateau of late 2025 giving way to calmer footing, expect a Q2–Q4 modest to significant increase in capital deployment, especially into growth-stage MedTech, AI-driven therapeutics, and device makers with strong regulatory pathways.

Employer impact: renewed hiring across R&D, clinical operations, commercial teams, and regulatory affairs.

Immigration Will Stabilize After the H-1B Turbulence

The 2025 H-1B shakeup created chaos for research labs, device developers, and engineering teams – but the dust has largely settled. With clearer rules and predictable wage tiers, companies now know how to plan. More Life Sciences employers will shift toward alternative pathways – O-1, TN, STEM OPT, and J-1 research programs – to secure global talent.

Employer impact: better workforce planning, more reliable candidate pipelines, and fewer emergency visa workarounds.

The Administration Will Push Domestic Drug and Device Manufacturing

We expect a 2026 push for “U.S.-based resilience” in pharmaceuticals, biologics, and medical devices. While the specific playbook is still forming, likely tools include:

- Executive Orders accelerating permitting and licensing for FDA-regulated manufacturing sites

- Near-shoring incentives for critical inputs (APIs, reagents, chips used in connected devices)

- Tax credits or expedited grants for domestic production of essential medicines and Class II/Class III devices

Employer impact: expanded facility operations, higher demand for manufacturing talent, and increased workforce mobility programs.

FDA Deregulation Boosts Commercial Hiring and Launch Velocity

A more deregulatory posture at the FDA will shorten timelines, ease certain labeling and post-market requirements, and speed up device modifications – paving the way for aggressive commercial expansion. Life Sciences companies will respond by hiring more sales reps, market-access specialists, and clinical educators to support faster launches.

Employer impact: larger commercial footprints, more salesforce restructuring, and heavier training obligations.

|

Want More?

|

Conclusion

We will continue to monitor developments related to all aspects of workplace safety law. Make sure you are subscribed to Fisher Phillips’ Insight System to get the most up-to-date information. If you have questions, contact your Fisher Phillips attorney, the authors of this Insight, or any member of our Life Sciences and Pharma Team or our Tech Sector Team.

Related People

-

- James C. Fessenden

- Partner

-

- Brandon Kahoush

- Partner

-

- Danielle H. Moore

- Executive Partner, Management Committee

-

- John M. Polson

- Chairman & Managing Partner

-

- Hannah Sweiss

- Partner