It’s that time of year again – employers are gearing up for the administrative marathon known as open enrollment season, when employees revisit their benefit plan choices for the upcoming plan year. This critical period consistently highlights the many complex rules applicable to employer-sponsored health and welfare plans, and this year brings some new additions due to changes in federal law. We’ll cover five key compliance areas for employers and share practical takeaways to help you stay compliant.

Annual Open Enrollment in the Workplace

- What Is It? Open enrollment is the designated period when eligible employees can make choices for the upcoming plan year regarding employer-sponsored health and welfare benefits – such as health, dental, vision, life, or other voluntary insurance coverage for themselves and their eligible dependents. This is the only time of year when employees can make such elections, aside from initial enrollment (at the time of hire or when an employee first becomes eligible to participate) or special enrollment periods (such as when an employee experiences a specific event that entitles them to make mid-year changes to their benefit elections).

- When Is It? The open enrollment period typically launches a month or two before coverage begins and lasts for roughly two to four weeks. For example, employers that operate their group health plans on a calendar-year basis often hold open enrollment in October or November before coverage begins on January 1.

- Why Have It? Designating a specific timeframe for all employees to make their benefits selections not only reduces the administrative burden on HR teams but also can be necessary for compliance purposes, as we’ll explain below.

|

Additional FP Reading. Check out our top tips for HR teams for a successful open enrollment season. |

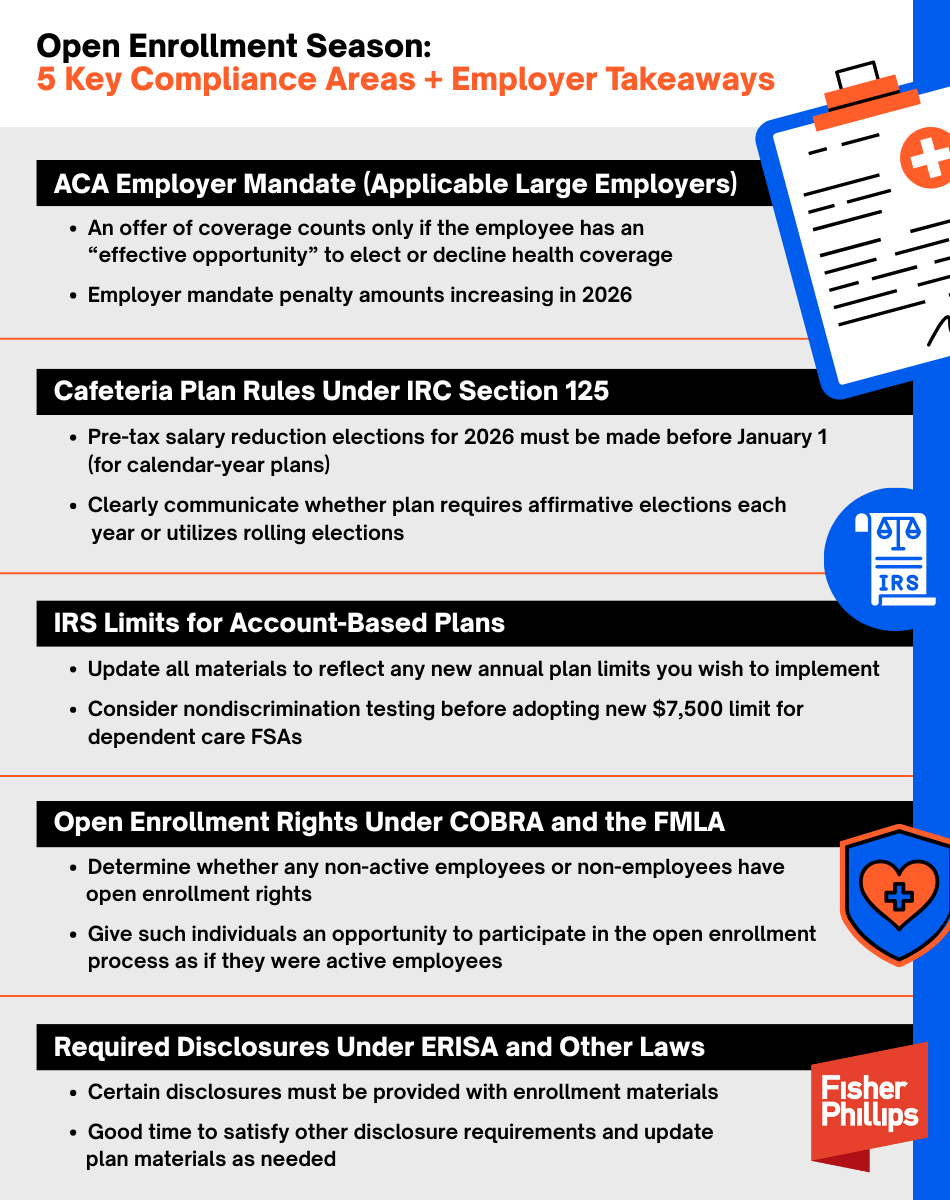

5 Legal Considerations + Employer Takeaways for Open Enrollment Season

Here are some key compliance areas to keep in mind for your organization’s open enrollment period.

|

OBBBA Updates. We’ve flagged the open enrollment compliance areas that may be impacted by the One Big Beautiful Bill Act (OBBBA), which was signed into law by President Trump in July. For a deeper dive on how employers will be impacted by the OBBBA, check out our prior FP insight. As a general note, the OBBBA’s sweeping changes to Medicaid and marketplace subsidies could shift more people to employer-sponsored coverage. If you have employees who are at risk of losing public or individual health insurance coverage, you should prepare for increased enrollment in your employer-sponsored group health plan, which could mean higher costs, more compliance risks, and heavier administrative burdens. |

1. Employer Mandate under the Affordable Care Act (ACA)

The ACA requires applicable large employers (ALEs) to offer qualifying health coverage to their full-time employees (and their dependents) or potentially be subject to Internal Revenue Service (IRS) penalties, which will significantly increase in 2026 (Revenue Procedure 2025-26). Your annual open enrollment period plays a critical role here because:

- The IRS will not treat an ALE as having made an “offer of coverage” to an employee unless it provides the employee an effective opportunity to enroll in the coverage (or to decline that coverage) at least once for each plan year. (Whether the health coverage is “affordable” and provides “minimum value” under the ACA is a separate determination).

- Whether an “effective opportunity” is provided depends on all the relevant facts and circumstances, including, for example, whether the employer adequately notified the employee about the offer of coverage and gave them sufficient time to decide whether to accept it.

- The same is true for determining whether the ALE made an offer of coverage to the employee’s dependents, which includes qualifying children under age 26 (but does not include spouses) under the employer mandate rules.

- While the IRS permits coverage elections that roll over from year to year unless the employee affirmatively elects to opt out of the plan to count as “offers of coverage,” holding an annual open enrollment period is still important to allow employees to make changes to their elections from a prior year.

|

Employer Takeaways

|

2. Cafeteria Plans under the Internal Revenue Code (IRC)

A “cafeteria plan” under IRC Section 125 permits employees to pay for health and welfare benefit costs (such as the employee’s portion of health insurance premiums) on a pre-tax salary reduction basis. For a cafeteria plan to keep its tax-favored status, participants’ elections generally must be made on a prospective basis and remain irrevocable during the plan year (subject to limited exceptions as permitted by the IRS and the plan document). Similar IRS rules apply to other employer-sponsored benefits, such as flexible spending accounts (FSAs) for health expenses.

|

Employer Takeaways Here’s how the cafeteria plan rules impact your annual open enrollment period:

|

3. IRS Limits for Account-Based Plans

Account-based health and welfare plans allow employees to set aside pre-tax dollars for certain qualifying expenses, and the IRS sets annual limits related to these accounts. Employers that offer these arrangements may establish lower limits, but most choose to maximize tax savings for their employees. Here are a few examples:

- Health FSAs. For 2025, the IRS permits an employee to contribute up to $3,300 to a health flexible spending account, and the maximum carryover amount (for plans that permit employees to carry over unused amounts from one plan year to the next) is $660. The IRS has not yet announced the limits for 2026, so stay tuned for updates.

- Dependent Care FSAs. Dependent care FSAs allow employees to use pre-tax dollars to pay for qualifying child and dependent care expenses. Thanks to the OBBBA, the per household annual contribution limit will increase – for the first time ever (aside from a one-time bump during the COVID-era) – from $5,000 to $7,500 starting in 2026 (the limit will increase to $3,750 if married filing separately).

- Health Savings Accounts (HSAs). For 2026, the annual HSA contribution limits, along with the minimum deductible and out-of-pocket maximum requirements for high-deductible health plans, are set out in Revenue Procedure 2025-19.

|

Employer Takeaways During the open enrollment process, you should:

In addition, employers should pay special attention to impending changes due to the OBBBA, including:

|

4. Open Enrollment Rights Under COBRA and the FMLA

During an employer’s open enrollment period for its active employees, it must make the same open enrollment period rights, such as an opportunity to switch to another plan or to add or eliminate coverage of family members, available to each qualified beneficiary receiving continuation coverage under the Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA).

Similar rules apply to employees on leave protected by the Family and Medical Leave Act (FMLA). For example, if your group health plan offers an annual enrollment period to active employees, then any employee on FMLA leave when open enrollment is offered must be given an opportunity to make election changes on the same basis as other employees.

|

Employer Takeaways Remember that your annual open enrollment period is not just for your employees who are actively working and can impact individuals who are no longer (or who never were) employed by you. Determine whether any other individuals, such as qualified beneficiaries receiving COBRA continuation coverage or employees out on FMLA leave, are legally entitled to participate in the process and give them an opportunity to do so as if they were active employees. |

5. Required Disclosures under ERISA and Other Laws

The Employee Retirement Income Security Act (ERISA) provides basic disclosure requirements for employee benefit plans, and a wide range of other laws (such as COBRA, the ACA, and the Health Insurance Portability and Accountability Act (HIPAA), and many others) provide additional disclosure requirements for group health plans.

Employers sponsoring group health plans must ensure that all required disclosures are timely distributed to the individuals entitled to receive them – including plan participants, beneficiaries, all eligible employees, or all employees regardless of plan eligibility or participation, depending on the specific disclosure. The specific disclosure requirements that apply to you depend on a variety of factors, such as the types of benefits you offer and whether your plan is fully insured or self-funded.

|

Employer Takeaways Here’s how your open enrollment period comes into play:

|

Conclusion

If you have questions about open enrollment compliance, strategies, or best practices, feel free to reach out to your Fisher Phillips attorney, the author of this Insight, or any attorney in our Employee Benefits and Tax Practice Group. We will continue to provide tips, guidance, and updates on employee benefits and other workplace law topics, so make sure you are subscribed to Fisher Phillips’ Insight System to get the most up-to-date information directly to your inbox.