Here Are the Jobs Covered By the “No Tax on Tips” Law – and What Employers Should Do Next

Insights

9.02.25

Employers got a sneak peek at the jobs that will qualify for the “no tax on tips” deduction over the holiday weekend thanks to a list obtained by Axios. The September 1 release provides the first real clarity on which occupations will be able to benefit from this new tax break. Employers in the hospitality, entertainment, and service industries should pay close attention, as this policy shift could not only reshape your recruiting and retention efforts but also impose new compliance responsibilities. Here’s the full list and some suggestions for best practices in light of the impending change.

[Ed. Note: The Treasury Department issued a proposed rule on September 22 that defines “qualified tips” and provides a list of eligible tipped occupations, which is consistent with the preliminary list described in this Insight.]

Quick Recap

As part of the “Big Beautiful Bill” reconciliation package passed by Congress and signed by the President on July 4, tipped and non-exempt workers will be able to deduct significant portions of their tip (and overtime) income from federal taxes starting in TY 2025. For employers, this could potentially make hospitality and similar jobs more attractive and assist with your recruitment and retention efforts.

You can read a full summary of the BBB impacts here, but the basics as they relate to “no tax on tips” include:

- Individuals must earn $150,000 or less in 2025 to eligible; for couples, the combined income limit is $300,000 (this threshold will be adjusted for inflation in future years)

- Only cash tips (including those charged and those received under tip-sharing) and tips reported to employers for payroll tax purposes are eligible

- The maximum deduction for tip income is $25,000 per year

- These exemptions will only apply in from TY2025 to TY2028 and will need to be extended by Congress to continue

Which Jobs Qualify?

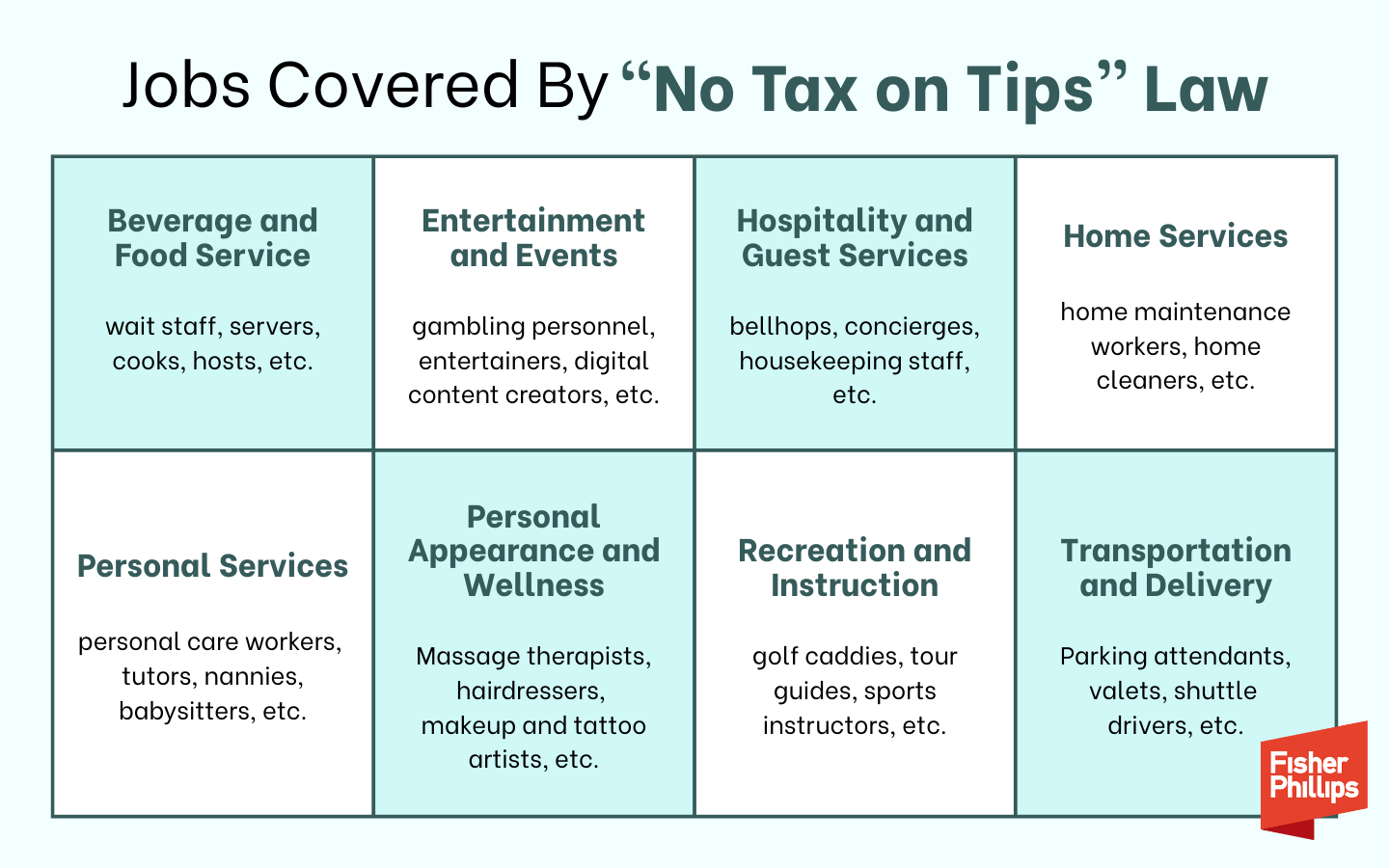

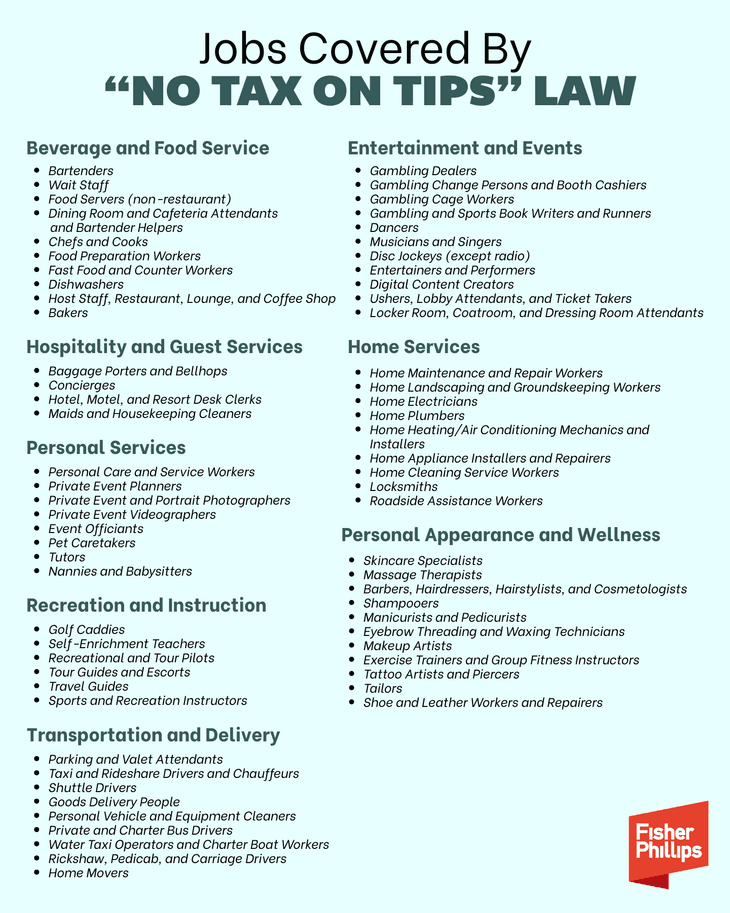

Congress did not articulate the specific jobs that would be covered by this policy. Instead, it ordered the Treasury Department to publish a comprehensive list of eligible tipped occupations by October 2. The list obtained by Axios and published on Labor Day contains eight separate categories broken down by occupation – and those in the hospitality industry will be the big winners under this new policy. Here is a quick summary, with the full and complete list of all 68 job titles listed below.

It is important to remember, however, that just because a job position is included in this list does not necessarily mean it is one for which employers can take a “tip credit” and pay a cash wage below the federal minimum wage. The “tip credit” is governed by a separate federal law – the Fair Labor Standards Act – and that law allows the “tip credit” pay model for only certain job positions.

What’s Next?

The list of jobs will be incorporated into formal federal regulations introduced by the Treasury Department before the October 2 deadline. We’ll soon see them published in the Federal Register and then take effect before the filing deadlines for TY2025.

What Should Employers Do?

- Review the list below to determine how many jobs in your organization will be affected by the change.

- Make sure to adjust your payroll system to accurately track and separately report cash and shared tips on W-2 forms.

- Train your staff and managers about these changes, and adjust your onboarding and orientation materials.

- Use the benefit of these policy changes in your recruiting and retention efforts. [Ed. Note: The IRS issued guidance on Nov. 5 that gives employers penalty relief for the 2025 tax year for certain failures related to new information reporting requirements added by the Big Beautiful Bill, such a failures to include a separate accounting of amounts designated as cash tips or the occupations of employees.]

Full List of Covered Positions

Here is the full list of the 68 positions that will be eligible for the new “no tax on tips” policy.

1. Beverage and Food Service

- Bartenders

- Wait Staff

- Food Servers (non-restaurant)

- Dining Room and Cafeteria Attendants and Bartender Helpers

- Chefs and Cooks

- Food Preparation Workers

- Fast Food and Counter Workers

- Dishwashers

- Host Staff, Restaurant, Lounge, and Coffee Shop

- Bakers

2. Entertainment and Events

- Gambling Dealers

- Gambling Change Persons and Booth Cashiers

- Gambling Cage Workers

- Gambling and Sports Book Writers and Runners

- Dancers

- Musicians and Singers

- Disc Jockeys (except radio)

- Entertainers and Performers

- Digital Content Creators

- Ushers, Lobby Attendants, and Ticket Takers

- Locker Room, Coatroom, and Dressing Room Attendants

3. Hospitality And Guest Services

- Baggage Porters and Bellhops

- Concierges

- Hotel, Motel, and Resort Desk Clerks

- Maids and Housekeeping Cleaners

4. Home Services

- Home Maintenance and Repair Workers

- Home Landscaping and Groundskeeping Workers

- Home Electricians

- Home Plumbers

- Home Heating/Air Conditioning Mechanics and Installers

- Home Appliance Installers and Repairers

- Home Cleaning Service Workers

- Locksmiths

- Roadside Assistance Workers

5. Personal Services

- Personal Care and Service Workers

- Private Event Planners

- Private Event and Portrait Photographers

- Private Event Videographers

- Event Officiants

- Pet Caretakers

- Tutors

- Nannies and Babysitters

6. Personal Appearance and Wellness

- Skincare Specialists

- Massage Therapists

- Barbers, Hairdressers, Hairstylists, and Cosmetologists

- Shampooers

- Manicurists and Pedicurists

- Eyebrow Threading and Waxing Technicians

- Makeup Artists

- Exercise Trainers and Group Fitness Instructors

- Tattoo Artists and Piercers

- Tailors

- Shoe and Leather Workers and Repairers

7. Recreation and Instruction

- Golf Caddies

- Self-Enrichment Teachers

- Recreational and Tour Pilots

- Tour Guides and Escorts

- Travel Guides

- Sports and Recreation Instructors

8. Transportation and Delivery

- Parking and Valet Attendants

- Taxi and Rideshare Drivers and Chauffeurs

- Shuttle Drivers

- Goods Delivery People

- Personal Vehicle and Equipment Cleaners

- Private and Charter Bus Drivers

- Water Taxi Operators and Charter Boat Workers

- Rickshaw, Pedicab, and Carriage Drivers

- Home Movers

Conclusion

Make sure you are subscribed to Fisher Phillips’ Insight System to get the most up-to-date information. If you have questions, contact your Fisher Phillips attorney, the authors of this Insight, any attorney on our Government Relations team or our Hospitality Industry team.

Related People

-

- Marty Heller

- Partner