Oregon and Washington just became the latest states to make striking employees eligible for unemployment compensation benefits. This marks a major policy shift for both states – especially for Washington, which currently disqualifies both striking workers and locked-out workers for benefits. We’ll explain everything you should know about the new laws that could disrupt labor negotiations and union dynamics in the Pacific Northwest and how this growing trend is evolving across the country.

Quick Background

- Unemployment insurance (UI) is a joint state-federal program that pays temporary cash benefits to qualifying unemployed workers. All states must comply with certain guidelines under federal law, but each state administers its own UI program and sets its own additional requirements.

- Most states treat striking employees as disqualified from receiving UI benefits, but many make exceptions for other types of labor disputes. For example, UI is available during lockouts (those work stoppages initiated by the employer) in many states.

- Until now, New Jersey and New York were the only two states that allowed striking workers to receive UI benefits. However, Oregon and Washington recently enacted similar laws that take effect in 2026, as we’ll break down for each state below.

- The new laws in Oregon and Washington could impact employers in significant ways. For example, strikes could last longer, as employees and unions may be disincentivized to end a strike once unemployment compensation kicks in. Further, employers with workers who strike long enough to qualify for benefits may see an increase in their UI rates.

OREGON

Gov. Tina Kotek signed a bill (SB 916) into law on June 24 that will allow striking workers to qualify for UI benefits starting in 2026. In a signing letter, Kotek said she considered all viewpoints from workers and employers in the debate over the bill, and that she believes the new law will help build a future where “workers and employers start on the same footing amid the competing and complicated dynamics that cause and perpetuate strikes.”

What’s Changing?

- Current Law. The state’s current UI law disqualifies individuals from receiving UI benefits if they are unemployed due to an active labor dispute at the individual’s place of employment – which includes strikes but does not include lockouts by the employer. The disqualification does not apply in certain limited circumstances (essentially, when an individual does not have any involvement in the dispute).

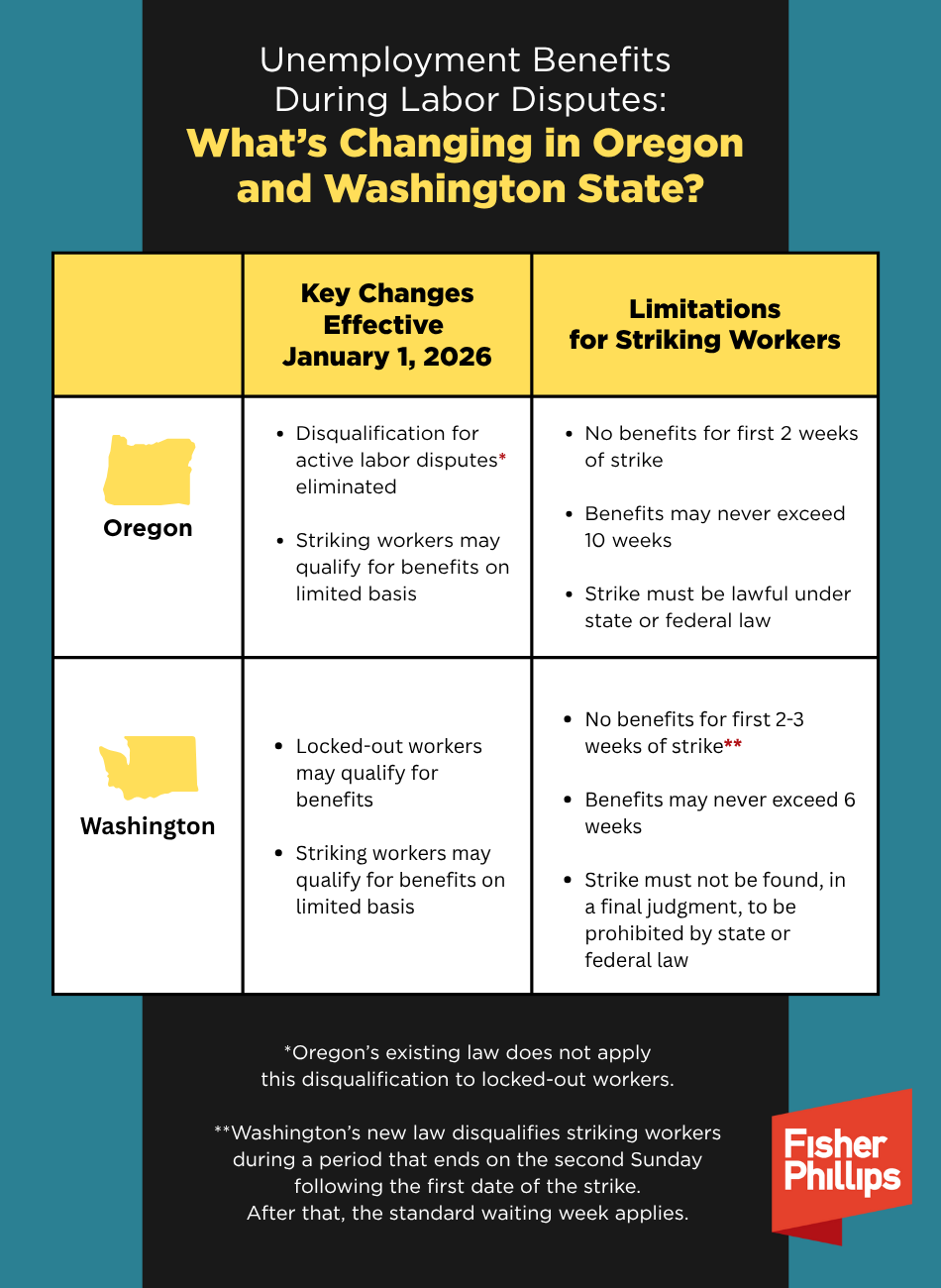

- New Law. Effective January 1, the labor dispute disqualification will be eliminated, allowing both striking workers and locked-out workers to qualify for UI benefits, so long as they are otherwise eligible. However, benefits for striking workers will be capped at 10 weeks, available only after a two-week waiting period (including a one-week disqualification period, plus the usual waiting period week), and required to be paid back if the individual receives back pay from an employer to resolve a strike.

|

New Defined Terms Under SB 916

|

How Will This Impact the Public Sector?

SB 916 is especially significant because it will allow striking workers in both the private and public sectors to qualify for UI benefits. “Oregon’s measure makes it the first state to provide pay for picketing public employees – who aren’t allowed to strike in most states, let alone receive benefits for it,” according to Oregon Public Broadcasting.

School districts, however, will be required to deduct the amount of benefits charged to the district for weeks during a labor a dispute from the recipient-employee’s future wages.

WASHINGTON

Gov. Bob Ferguson signed a bill (SB 5041) into law earlier this year that will drastically change the state’s unemployment compensation rules for labor disputes starting in 2026. “Strikes are a last resort, and while they are an important tool for workers, they can be financially debilitating,” Ferguson said. “This bill ensures workers have the resources they need to effectively bargain with their employers.

What’s Changing?

- Current Law. The state’s existing rules disqualify an individual for benefits if their unemployment is due to a strike at their place of employment or a lockout by their employer if it is a member of a multiemployer bargaining unit. The disqualification does not apply if the individual (along with others in the same grade or class) is not participating in, financing, or directly interesting in the strike or lockout that caused their unemployment.

- New Law. Effective January 1, both striking and locked-out workers may qualify for benefits so long as they are otherwise eligible. However, like Oregon’s new law, benefits for striking workers will be subject to limitations, as explained below. Washington’s new law includes a sunset provision and will expire in 2036 unless lawmakers decide to extend it.

How Will Washington Limit Benefits for Striking Workers?

Any individual who is unemployed due to a strike at their place of employment will be disqualified for benefits until the earlier of the second Sunday following the first date of the strike or the date the strike is terminated. After that, striking workers may qualify for up to six calendar weeks of benefits following the standard one-week waiting period – provided that the strike is not found to be prohibited by federal or state law in a final judgment (in which case, any benefits paid are liable for repayment).

In addition, striking workers will be required to repay overpayments to the state’s Employment Security Department (ESD) for benefits received for any week for which they subsequently received retroactive wages from the separating employer.

How Will This Impact Washington Employers’ Unemployment Tax Rate?

If the separating employer is a covered contribution paying base year employer, benefits paid to eligible striking employees will be charged to the experience rating account of that separating employer only.

However, an employer that is charged benefits due to a strike may be eligible to make a voluntary contribution to the state’s UI trust fund, which could potentially lower the employer’s unemployment tax rate. SB 5041 permits EDS to notify employers of this opportunity if the department determines that the employer is eligible for the state’s voluntary contribution program.

NATIONWIDE

More states are considering unemployment benefits for striking workers, and we previously covered what employers should know about this growing trend. So far, however, Oregon and Washington are the only states to join New Jersey and New York in enacting such laws.

While Connecticut’s proposed bill was passed by lawmakers this year, Gov. Ned Lamont vetoed it on June 23. “Unemployment Trust Fund exists to provide support to individuals who are out of work through no fault of their own, and its long-term sustainability is critical,” Lamont said in a veto message. “Extending benefits to individuals actively participating in labor disputes-even after a period of time-alters the fundamental purpose of the program.” Similarly, a California bill passed by state lawmakers in 2023 was rejected by Gov. Gavin Newsom. In his veto message, Newsom cited the state’s outstanding debt owed to the federal government for UI loans and said that any expansion of eligibility for UI benefits could increase that debt and, ultimately, taxes on employers. (As of December 2024, California’s federal UI loan balance exceeded $20 billion).

At the federal level, Republican lawmakers are moving to disqualify individuals who are unemployed as the result of a strike or other labor dispute (other than a lockout). Last week, Congressman Rudy Yakym introduced the Securing Help for Involuntary Employment Loss and Displacement (SHIELD) Act. In a press release about the proposed SHIELD Act, Yakym criticized the new laws in Oregon and Washington before concluding: “If you choose to strike, you don’t get to collect a check from hardworking Americans, plain and simple.”

Conclusion

Make sure you are subscribed to Fisher Phillips’ Insight System to get the most up-to-date information. For more information about this legislation, feel free to contact your Fisher Phillips attorney, the authors of this Insight, any attorney in our Labor Relations Practice Group, or any attorney in our Portland (OR) or Seattle offices.