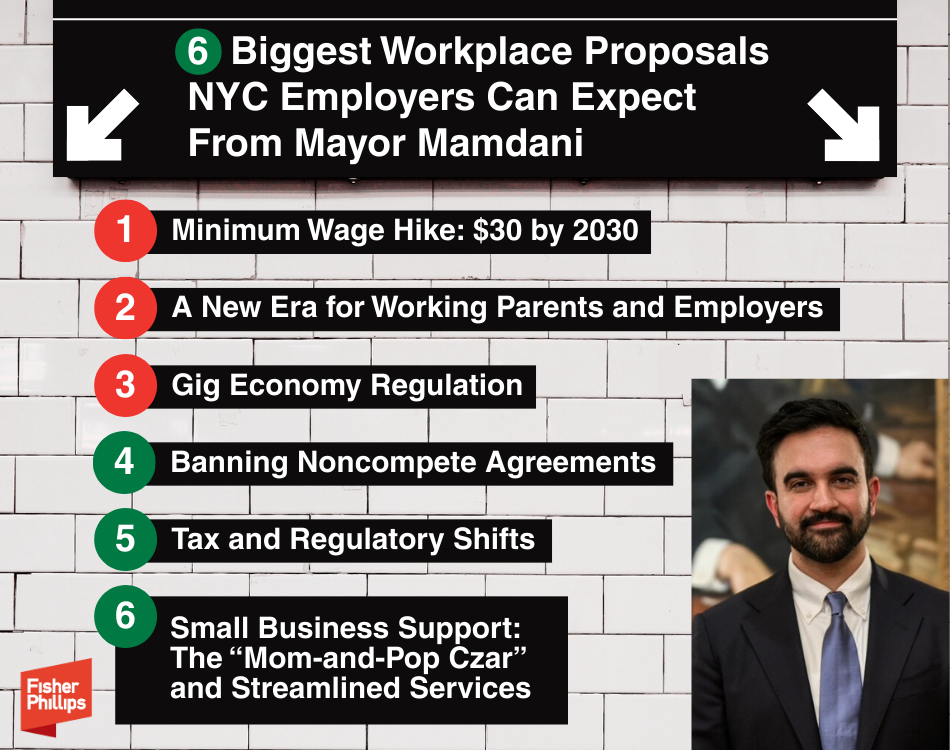

As New York enters a new era in city leadership, employers should prepare for significant changes in workplace regulation and employee rights. On January 1, Mayor-elect Zohran Mamdani will take office, advancing a platform focused on affordability, expanded worker protections and regulatory reform. For businesses across the five boroughs, 2026 is poised to bring both new opportunities and compliance challenges as the administration pursues its ambitious agenda. This alert highlights the six most significant policy initiatives expected under the new mayor, analyzes their potential impact on employers, and offers practical steps to help organizations prepare for the evolving legal landscape.

1. Minimum Wage Hike: $30 by 2030

A cornerstone of Mamdani’s platform is a proposal to raise the minimum wage to $30 an hour by 2030 – nearly double the current rate of $16.50. The increase would be phased in, with smaller businesses receiving more time to adjust. The stated goal is to ensure that minimum wage earners are not living in poverty.

For employers, this proposal presents both challenges and opportunities. Higher wages will increase labor costs and strain margins, particularly for businesses already contending with high rents and operating expenses. While critics warn of potential job losses and increased automation, supporters argue that higher wages could boost consumer spending and benefit the broader economy.

Even if the full increase is not enacted, upward wage pressure is expected to continue. In 2026, the minimum wage will rise to $17 per hour in New York City. Employers should proactively model payroll costs under phased increases and review pricing strategies to prepare for higher labor expenses.

2. A New Era for Working Parents and Employers

Mamdani has also proposed universal, high-quality childcare for all New Yorkers aged six weeks to five years, modeled after successful programs in Quebec. Universal childcare is credited with boosting workforce participation, reducing absenteeism, and saving families significant costs. Advocates have pointed out that, in 2022 alone, New York City reportedly lost $23 billion in economic activity due to parents leaving jobs or reducing hours for childcare. With average childcare costs exceeding $14,000 per child in 2023, according to data from the US Department of Labor, expanded access could ease recruitment and retention challenges, especially in industries affected by caregiving responsibilities.

Major employers are already engaging with the mayor-elect to explore public-private partnerships. While details regarding eligibility and funding are still in development, businesses should anticipate a citywide push to make childcare more accessible. Notably, a Siena University poll found nearly two-thirds of state voters support universal childcare funded by higher taxes on those earning more than $1 million. However, the plan’s success depends on new taxes on corporations and high earners, requiring approval from Albany. While Governor Hochul supports universal childcare in principle, funding remains a significant hurdle.

3. Gig Economy Regulation

Mamdani’s administration is expected to pursue greater protections for independent contractors, particularly the city’s 80,000+ delivery workers. Plans include strengthening licensure requirements for delivery apps, expanding worker protections and investing in safer street infrastructure, such as e-bike programs and “deliverista hubs.”

For employers in the restaurant, retail, grocery, and logistics sectors, these changes could mean new compliance obligations and higher costs as platforms adjust to stricter rules. While improved protections may stabilize a sector plagued by turnover and safety concerns, businesses relying on delivery services may need to renegotiate contracts or adjust logistics strategies. The City Council has already been a national leader in regulating delivery apps, and further legal developments are likely.

4. Banning Noncompete Agreements

Mamdani’s platform includes a ban on non-compete agreements for workers in New York City, arguing that such agreements restrict worker mobility and suppress wages. The mayor-elect aims to revive a 2024 City Council proposal that stalled, while similar statewide legislation remains under consideration after a 2023 gubernatorial veto. Employers should monitor developments closely, as new restrictions on non-competes could require significant changes to employment agreements and talent management strategies.

5. Tax and Regulatory Shifts

Mamdani’s revenue plan calls for raising the corporate tax rate to 11.5% (matching New Jersey) and imposing a 2% tax on New Yorkers earning above $1 million annually. Additional promises include procurement reform, stricter auditing and tougher enforcement against landlords and businesses that violate city regulations.

A key component of Mamdani’s pro-employee platform is a proposal to double the budget of the Department of Consumer and Worker Protection (DCWP), expanding its capacity to enforce wage theft, misclassification, and scheduling laws. This signals heightened scrutiny and potentially larger fines for employers. At the same time, Mamdani proposes halving small business fines and adopting a “fix, don’t fine” approach for first-time offenders, reflecting a dual strategy of tougher enforcement for large corporations and relief for smaller businesses.

The mayor-elect has also pledged to invest in the city agency responsible for addressing workplace discrimination. The Commission on Human Rights has faced persistent challenges, including staffing shortages and significant case backlogs. Mamdani has proposed a 45% increase to the agency’s budget, which could enable a more aggressive enforcement strategy. The additional funding is expected to support the hiring of dozens of new personnel, which may result in a surge of investigations and lawsuits related to workplace discrimination.

Employers should strengthen compliance programs, particularly regarding scheduling, classification, wage practices and anti-discrimination policies. While enforcement expansion is likely, new taxes will almost certainly face resistance in Albany, which may result in some proposals being scaled back or delayed.

6. Small Business Support: The “Mom-and-Pop Czar” and Streamlined Services

Recognizing that small businesses account for over 90% of city businesses and employ nearly half of private-sector workers, Mamdani plans to appoint a “Mom-and-Pop Czar” to streamline permitting, reduce fees, and expand support programs. The initiative includes a 500% funding increase for Business Express Service Teams (BEST), modeled after successful programs in Pennsylvania that dramatically reduced permitting times.

For smaller employers, this could mean faster business openings, fewer regulatory bottlenecks, and more accessible city resources. Improvements to the MyCity Business Portal will also facilitate digital applications and case tracking. However, these changes will take time to implement, so businesses should expect gradual improvements rather than immediate results.

Mamdani Will Face Political and Fiscal Realities

While Mamdani will enter office with strong union support and grassroots momentum, he’ll still face immediate hurdles as he tries to roll out all of these initiatives. Proposals such as minimum wage increases and new taxes require approval from the state legislature and Governor Hochul, which is not guaranteed. The city’s fiscal outlook is tight, and ambitious programs like universal childcare require substantial new revenue.

Additionally, Mamdani must also negotiate contracts with DC 37, the city’s largest public-sector union, and address ongoing litigation over health benefit changes – issues that could consume significant political capital. The City Council will play a critical role in determining the pace and scope of reforms, with potential pushback on measures seen as burdensome to business or difficult to fund.

How Can Employers Prepare For a Worker-First Agenda?

In 2026, New York City employers should anticipate a mix of new obligations and new supports. Universal childcare and small business reforms could ease workforce challenges, while wage hikes, tax increases, and stricter enforcement may raise costs. Delivery app regulation will reshape a fast-growing sector, and political dynamics will influence the speed and scope of these changes.

To prepare, employers should strengthen compliance efforts, model financial impacts early, and stay engaged with city programs as they roll out. While not all of Mamdani’s proposals will survive the political and fiscal gauntlet, the direction is clear: New York City is moving toward an even more worker-first agenda and employers who adapt quickly will be best positioned to thrive.

Conclusion

We will continue to monitor developments on these bills, so make sure you are subscribed to Fisher Phillips’ Insight System to get the most up-to-date information directly to your inbox. If you have questions, contact your Fisher Phillips attorney, the authors of this Insight or any attorney in our New York City office.