“One Big Beautiful” School Choice: Budget Bill Provides Key Tax Break That Could Help Your K-12 School

Insights

8.07.25

The “One Big Beautiful Bill” passed by Congress and signed into law by President Trump last month includes a new federal tax credit program for donations that could significantly expand private school scholarship options if your school is in a state that chooses to participate. What do you need to know about this under-the-radar provision that takes effect in 2027 and what can you do to take advantage of the change?

|

Big Beautiful Bill for Employers If you want a summary of key aspects of the budget bill as they relate to the workplace, click here for our full recap. |

What Does the New School Choice Provision Say?

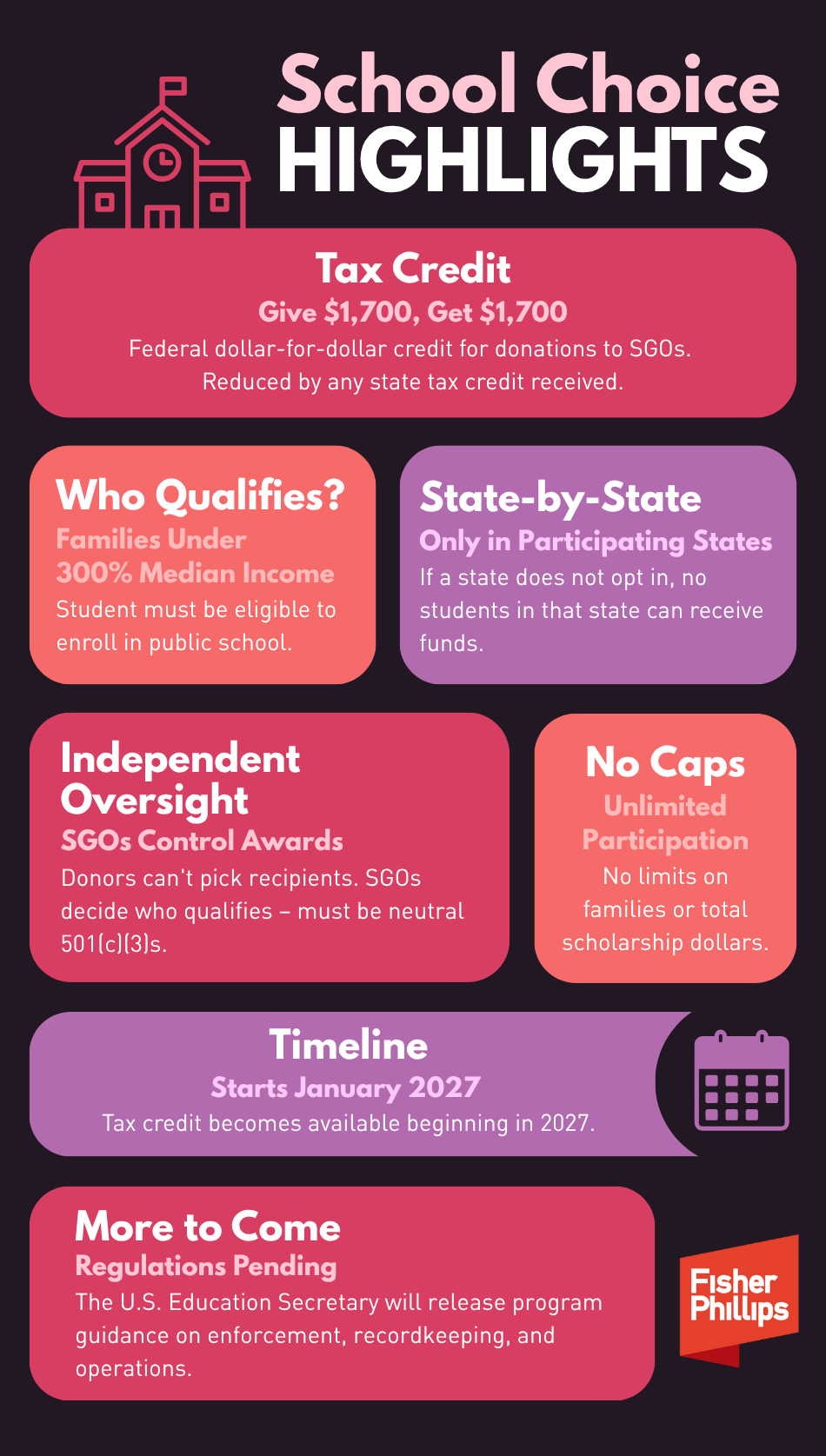

- Tax Credit: Eligible taxpayers can donate up to $1,700 to covered scholarship granting organizations (SGOs) and receive a dollar-for-dollar tax credit. This tax credit would be reduced by any state tax credit the donor receives.

- Qualifications: To be eligible for the scholarship program, the family’s household income must not exceed 300% of the median gross income where they live, and the student must be eligible to enroll in public school. Qualifying students can use the funds to pay for tuition and other related expenses of their choice.

- State-Dependent: States must voluntarily elect to participate to receive this funding. If a student is in a state that decides not to participate in the program, then none of the students in that state would be eligible to receive scholarship funds.

- Schools Retain Choice: Donors cannot mandate that their contribution go to a particular family. Similarly, parents cannot assign their tax credit directly to their child’s educational expenses. Instead, the SGOs will be charged with independently determining students’ eligibility. The SGOs must be independent 501(c)(3) entities that are not affiliated with a school and must meet other criteria set forth in the law.

- No Caps: The law does not have any caps the number of families that can participate in the program or the total scholarship amounts available.

- Effective Date: The federal tax credit for eligible donations takes effect starting in January 2027.

- Stay Tuned: The federal government is required to draft regulations and other guidance detailing how the program will operate, including recordkeeping and reporting obligation, as well as enforcement of a state’s certification of SGOs.

How Will This Affect Private and Independent Schools?

The answer to this question will largely depend on whether your state’s Governor opts in to this program. If your school is in a state that does not currently have a school choice program in place, a state can still choose to participate if an eligible SGO is developed. If your state chooses to participate, your school may see increased applicants.

States need to elect participation in time for the initial scholarship and donation cycle (i.e., before the program launches in 2027). Stay tuned for an announcement from officials in the state in which you operate to determine whether your school will be eligible.

|

Questions remain about whether a school can opt out of this program if their state chooses to participate. Also, if a school decides to participate, we do not know if it would be considered receipt of federal financial assistance. If it is, then your school would have to comply with various federal laws such as Title IX, Section 504 of the Rehabilitation Act, the Family Educational Rights & Privacy Act (FERPA), and other similar laws. |

Additionally, we do not yet know how the federal program would interact with existing state scholarship programs. Would families have to choose one program over the other, or could they receive both scholarships? These questions remain currently unanswered.

Conclusion

If you have any questions about how these changes affect your school, please contact your Fisher Phillips lawyer, the authors of this Insight, or any member of our Education Practice Group. Fisher Phillips will continue to monitor further developments and provide updates in the coming months, so make sure you are subscribed to Fisher Phillips’ Insight System to gather the most up-to-date information.

Related People

-

- Ilanit Fischler

- Partner