New Jersey Employers Face Another Minimum Wage Increase in 2026: Your Compliance Guide for the Year Ahead

Insights

10.14.25

For the eighth year in a row, New Jersey will be increasing its minimum wage effective January 1, 2026. Under a law passed in 2019, the New Jersey Department of Labor and Workforce Development (NJDOL) initially set a new minimum wage rate in 2024 and sets the wage for the coming year based on an increase in Consumer Price Index (CPI) data provided by the U.S. Bureau of Labor Statistics. The NJDOL recently announced on October 1 that, based on CPI data, the minimum wage will increase by 43 cents to $15.92 per hour for most employees, fulfilling what Governor Murphy called “making the dream of a livable wage a reality.” Here is a summary of the increases that will soon take effect, along with some compliance recommendations to prepare.

Summary of 2025 Minimum Wage Levels

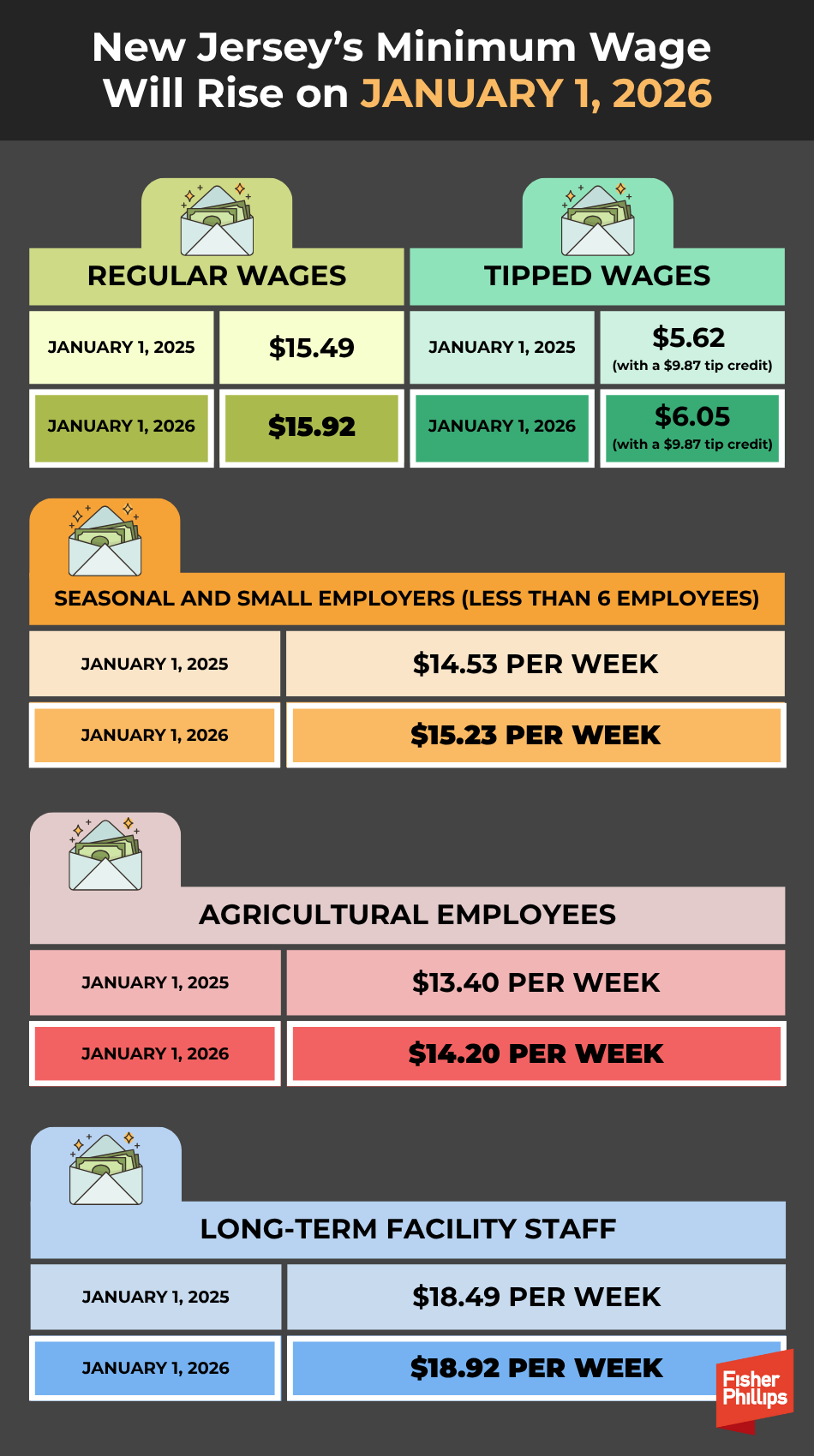

According to the recent NJDOL update, the following minimum wage increases will go into effect on January 1, 2026:

- Most employers: increase from $15.49 to $15.92 per hour

- Tipped employees: increase from $5.62 with a $9.87 tip credit to $6.05 per hour with the maximum tip credit remaining at $9.87

- Seasonal and small employers (fewer than six employees): increase from $14.53 to $15.23 per hour.

- Agricultural employees: increase from $13.40 to $14.20 per hour

- Long-term facility staff: increase from $18.49 to $18.92 per hour

What Should You Do?

Compliance with the new minimum wage rates is essential for all New Jersey employers.

- New Jersey’s Wage Theft Act criminalizes certain wage and hour violations and the damages, penalties, and fines for violations are significant.

- If an employee is not paid properly – including not being paid at the correct minimum wage – they may be able to recover liquidated damages of 200% in addition to the original wages they were owed.

- Additionally, be aware that the state’s minimum wage will continue to increase annually based on any increase in the CPI and budget accordingly.

- As costs continue to rise, state lawmakers may introduce new legislation to increase the minimum wage rate further. We’ll track potential increases and provide updates as necessary.

Conclusion

If you have any questions about New Jersey’s minimum wage laws and how these changes may impact your business, please contact your Fisher Phillips attorney, the authors of this Insight, or any attorney in our New Jersey office. Make sure you are subscribed to the Fisher Phillips Insight System to get the most up-to-date information.

Related People

-

- Dylan Teixeira

- Associate

-

- Sarah Wieselthier

- Partner