Managing Director Personally on the Hook for $2 Million in Wage Violations: 6 Steps to Avoid Liability

Insights

10.30.25

Business owners, executives, and managers need to pay attention to wage and hour compliance or risk personal liability. In a recent ruling under federal and New Jersey wage and hour law, a managing director with some ownership interests in several pawn shops was held personally liable for upwards of $2 million for wage violations. Here’s what business leaders can learn from this class-action lawsuit, and six ways to shield yourself and your company.

Manager Found Personally Liable

This class-action lawsuit involved 18 former employees alleging wage violations of the Fair Labor Standards Act (FLSA) and the New Jersey Wage Hour Law (NJWHL).

US District Judge William J. Martini held that the managing director of the Perfect Pawn was an “employer” within the meaning of the FLSA and NJWHL. The court also found that the director violated federal and state wage and hour laws by:

- knowingly misclassifying employees;

- lowering their salaries without notice;

- failing to pay them minimum hourly wages and overtime premiums;

- failing to timely pay his employees; and

- ignoring his CFO’s warning about unpaid wages.

While this case involves an extreme example of a manager who ignored clear warnings and knowingly violated wage laws, it highlights the risks that could apply broadly to individuals responsible for business operations and payroll. Even unintentional mistakes in classifying workers or calculating pay can lead to significant violations with serious and costly consequences. Employers should review their pay policies now, before a small oversight becomes a major liability.

Who is Considered an Employer?

This case underscores a key point: Owners, executives, managers and others who control payroll practices or employee working conditions can face personal exposure for unpaid wages, penalties (such as double or triple damages), and attorneys’ fees and costs.

An individual can be classified as an “employer” under the FLSA and the NJWHL if they act, either directly or indirectly, in the interest of a company concerning an employee.

The standard applied by the court may depend on your location. The 3rd US Circuit Court of Appeals – which includes New Jersey, Pennsylvania, and Delaware – applies the Enterprise test to evaluate an individual’s employer status. An individual is considered an employer if they:

- hire and fire employees

- create work schedules and assignments

- establish work rules

- set compensation

- oversee the daily operations involving employees

- exercise control over employee records

This list is not exhaustive, and courts have the discretion to take into consideration other factors to determine whether an individual is an “employer.”

In the Perfect Pawn case, the federal court found that the managing director met all the necessary standards for “employer” status because he was the only person who had the authority to oversee daily operations, manage staff, and control payroll matters. He had the authority to run the company the way he saw fit, according to the court.

As a result, the court found that the director’s failure to timely pay wages, reduction of salaries without notice, and failure to pay overtime to workers who were misclassified as exempt rendered him personally liable as an “employer.”

Checkmate for Perfect Pawn: A $2 Million Lesson

The business failed to keep adequate payroll records, according to the court, so it accepted the evidence submitted by the class regarding unpaid wages and overtime when awarding damages.

Notably, the court calculated the damages over a 52-week period for all 18 employees, which totaled nearly a million dollars. Although the court decided against tripling damages under New Jersey law, the judge did award liquidated (double) damages under the FLSA, finding that the managing director did not act in good faith when he ignored the CFO’s warnings regarding unpaid wages. He simultaneously increased his own salary and directed the CFO to withhold his employees’ wages. The court calculated the damages at $1.9 million, with additional amounts to be awarded for attorney’s fees and costs.

6 Steps to Protect Yourself and Your Business

Business leaders who maintain proper classifications minimize the risk of disputes arising from misunderstandings about employee roles and compensation. If you have concerns regarding potential misclassification, seeking legal advice is strongly recommended to help you navigate the complexities.

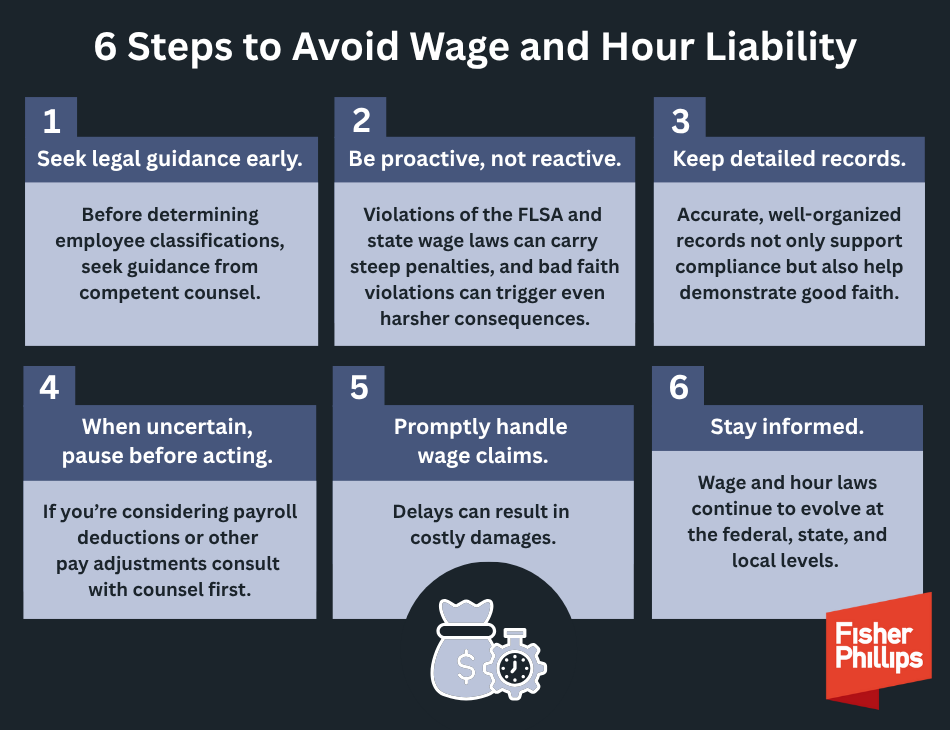

As can be seen from the Perfect Pawn decision, employee classification and wage compliance have become increasingly risky areas for individuals in management positions who may be held personally responsible for business errors. A proactive approach can help protect you from future legal issues. Consider taking the following six steps:

1. Seek legal guidance early. Before determining employee classification – exemption or contactor status – seek guidance from competent counsel. In most situations, adopting a cautious stance on classification and pay practices is the safer course.

2. Be proactive, not reactive. Violations of the FLSA and state wage laws can carry steep penalties, and bad faith violations can trigger even harsher consequences, including personal liability for those involved in pay decisions. Proactive reviews and audits of your pay practices can help identify and correct issues before they lead to claims.

3. Keep detailed records. Document how you classify employees and determine compensation. Accurate, well-organized records not only support compliance but also help demonstrate good faith if your practices are challenged.

4. When uncertain, pause before acting. If you’re considering payroll deductions or other pay adjustments that could implicate minimum wage or overtime rules, consult with your Fisher Phillips counsel first. A quick conversation can prevent costly errors.

5. Promptly handle wage claims. When employees have questions or make formal or informal complaints about their pay, seek counsel immediately as any delay can result in damages.

6. Stay informed. Wage and hour laws continue to evolve in federal, state, and local levels. Keep an eye on developments in the cities and counties where you operate.

Conclusion

For more information or assistance in taking the actions described above, contact your Fisher Phillips attorney, the authors of this Insight, or any attorney in our Wage and Hour Practice Group or New Jersey office. Make sure you are subscribed to Fisher Phillips’ Insight System to receive the most up-to-date information directly to your inbox.

Related People

-

- Kathleen McLeod Caminiti

- Partner and Co-Chair, Wage and Hour Practice Group

-

- Madeline B. Gayle

- Associate