Colorado employers should be aware of a recent enforcement uptick regarding online job posting rules – especially since missteps can result in huge fines up to $10,000 per violation. The Colorado Equal Pay for Equal Work Act (EPEWA) requires employers to include detailed information about pay, benefits, and application logistics in their job postings. These requirements have been in place since 2021 and all Colorado employers should have already incorporated them into the hiring process. Unfortunately, however, employers may not realize that not just job seekers but the government can search their job postings – and that enforcement efforts are rising. Given the high stakes for violations, now is a great time to review your job postings for compliance and curb the potential for costly errors. Here are the answers to your top five compliance questions.

1. What Counts As a Posting?

The EPEWA’s requirements apply to postings for any “job opportunity,” which is defined as a current or anticipated vacancy for which the employer is considering candidates.

Job opportunities must be posted internally. There is no requirement to post externally, but the law’s requirements apply to external postings to the public in addition to internal notifications sent to current employees. Notably, it extends to remote positions that could be performed in Colorado in addition to jobs physically located in the state.

Many employers prioritize finding prospective candidates externally through online postings either on their own websites or through online job boards. Recently, the Colorado Department of Labor and Employment (CDLE) has taken the initiative to police these postings for compliance, given their easy accessibility, making it more important than ever to make sure your job postings are not a target.

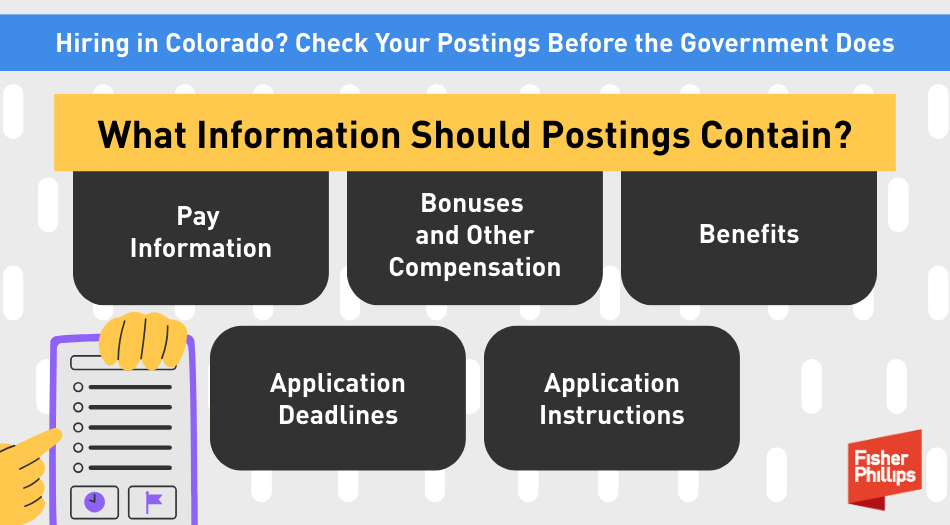

2. What Information Should Postings Contain?

Each posting must include at least the following five categories of information:

- Compensation Information. The posting must state the salary or hourly wage. Ranges (such as “$20 to $25 per hour” or “$70,000 to $90,000” per year) are permissible, as long as they reflect what the employer genuinely believes it might pay in view of the prospective employee’s qualifications and the operational needs of the company. Unbounded ranges (like “$20 per hour and up” or “up to $100,000 per year”) are not permitted. Employers should be wary of providing an upper bound for a salary range that is unreasonably high for the position, as overly broad ranges might invite scrutiny from the CDLE.

- Bonuses and Other Compensation. If the job is eligible for a bonus or other form of compensation (like tips, sales commissions, a housing stipend, or vehicle reimbursement), the employer must include this information. Generally, if in doubt whether something counts as “compensation,” it should be included. When possible, it is advisable to post ranges of potential compensation.

Tipped positions pose a particular compliance challenge. It is critical that employers not count the tips as part of the expected pay range in the postings, but should instead note the base pay or pay range and indicate it is a tipped position (such as “$20 per hour, plus tips”). The posting need not include a range of expected tips, but a range can be provided so long as the employer has a good faith belief that it accurately reflects the expected tips for the position. As with expected compensation, overpromising more tips than could be reasonably expected can trigger unwanted scrutiny from the CDLE.

- Benefits. Your postings must include a general description of all employment benefits, including health care, retirement benefits, paid days off, and any other benefits that must be reported for tax purposes. Employers may be surprised to learn that the CDLE takes the position that the description of benefits must also include benefits that are mandated by law, such as paid sick leave under the Colorado Healthy Families and Workplaces Act. Minor perks (such as free coffee or snacks) are excluded from this requirement.

- Application Deadlines: The posting must also include the application window, including any relevant closing date for applications. If applications are considered on a rolling or “as needed” basis, the posting should make that clear. Employers should also take care to remove job postings once the position has been filled or is otherwise no longer available.

- Application Instructions: Intuitively, the posting needs to explain how candidates can actually apply for the opportunity.

3. When Are Postings Covered?

The law generally applies to all employers posting job opportunities in Colorado, with limited exceptions for employers located outside Colorado with fewer than 15 employees who are working remotely in the state. The requirements also apply to remote positions that could be performed by a Colorado resident even if the employer is located elsewhere. If an employer permits employees to work remotely from anywhere in the United States, they should anticipate that these requirements apply to their job postings.

4. How Are Investigations Launched?

Job posting rules are governed by the CDLE, which handles complaints about violations and can also launch investigations on its own.

Being proactive is key. No employer wants to learn about noncompliant postings through an enforcement letter from the CDLE, when it is obviously too late. In practice, the CDLE sometimes offers employers a brief opportunity to fix noncompliant postings before initiating an investigation, but such “educational” remedial opportunities are not guaranteed.

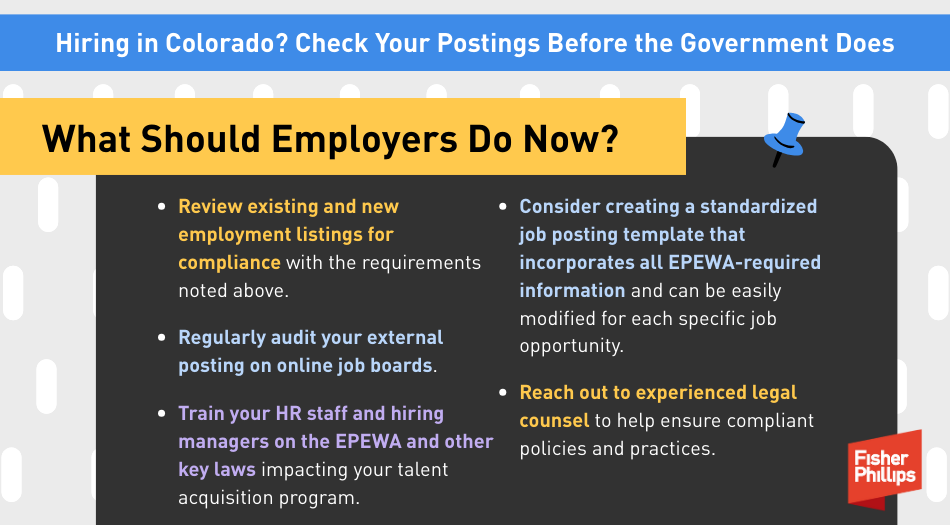

5. What Should Employers Do Now?

- Review existing and new employment listings for compliance with the requirements noted above.

- Regularly audit your external positing on online job boards.

- Train your HR staff and hiring managers on the EPEWA and other key laws impacting your talent acquisition program.

- Consider creating a standardized job posting template that incorporates all EPEWA-required information and can be easily modified for each specific job opportunity.

- Reach out to experienced legal counsel to help ensure compliant policies and practices.

Conclusion

If you have questions about these requirements, including whether your postings comply with applicable law, please contact your Fisher Phillips attorney, a member of the Pay Equity and Transparency Practice Group, an attorney in our Denver office, or the authors of this Insight. Make sure you are subscribed to Fisher Phillips’ Insight System to get the most up-to-date information.