Federal Appeals Court Decision Reminds Employers About Their Duty to Monitor Service Providers of ERISA-Covered Health and Welfare Plans

Insights

5.30.25

A federal appeals court just illustrated the importance of an employer’s duty to monitor service providers that assist with the administration of employee welfare benefit plans. In the May 21 decision of Tiara Yachts v. Blue Cross Blue Shield of Michigan, the 6th Circuit Court of Appeals held that the employer adequately alleged that its third-party claims administrator (TPA) was a fiduciary and, as such, violated ERISA by causing the employer’s welfare plan to overpay medical claims. It also held that the employer is authorized under ERISA to seek equitable remedies from the TPA in the form of disgorgement of profits. What do you need to know about this decision, and what are the three big takeaways?

How a Claims Payment Dispute Sparked an ERISA Showdown

The employer, Tiara Yachts, alleged that its welfare plan’s TPA, Blue Cross Blue Shield of Michigan (BCBSM), systemically allowed out-of-network medical providers to overbill the employer’s welfare benefit plan for services that participant employees received from those out-of-network providers. In addition, the employer alleged that BCBSM used the “Shared Savings Program” to pay itself for correcting those provider overpayments. As alleged by the employer, BCBSM improperly made money from the welfare plan based on the problems it created through a flawed claims payment system.

The lower court dismissed the employer’s claims under the Employee Retirement Income Security Act (ERISA), but the 6th Circuit Court of Appeals reversed and revived the claims.

Why This Case Matters for Every Employer with a Health Plan

The Tiara Yachts case may at first sight appear like a backwater dispute with limited ramifications beyond the alleged claims mismanagement issues. BCBSM attempted to bring the case within the narrow compass of a contract dispute regarding the sufficiency of its services. But the court of appeals rejected the invitation to view the contention as a skirmish over contractual obligations. Rather, it held that the dispute was squarely an ERISA matter, raising issues about plan administration and BCBSM’s related, alleged fiduciary misconduct in mishandling claims and controlling plan assets.

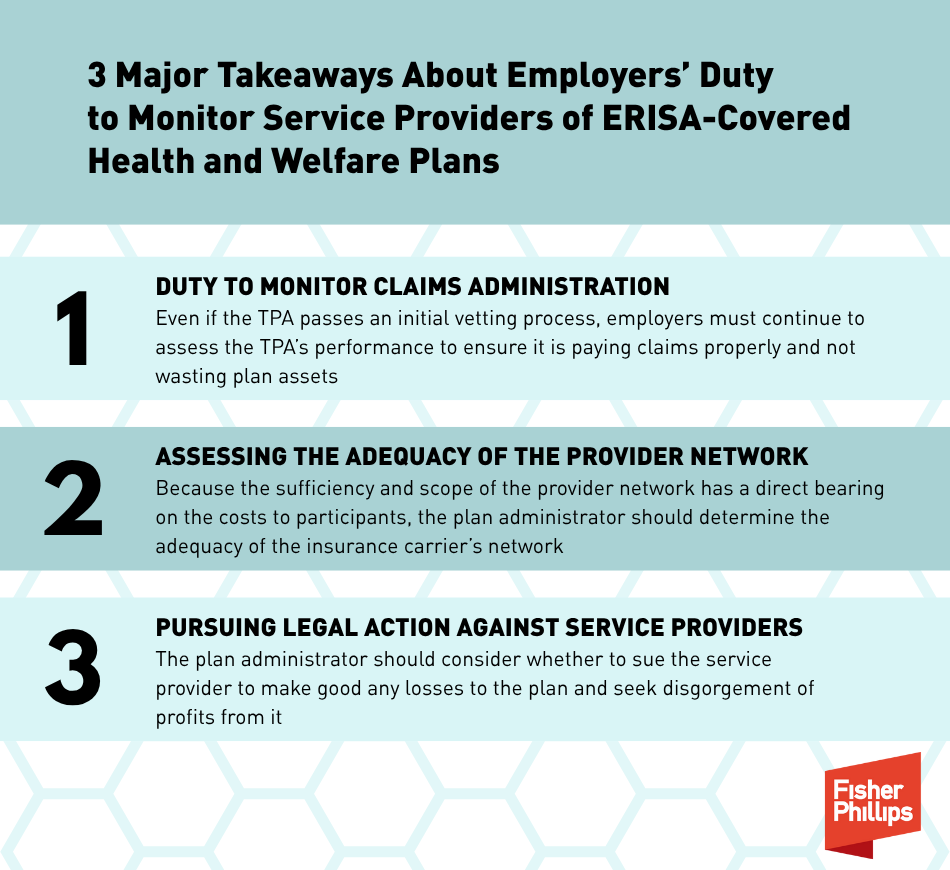

3 Major Takeaways

The dispute between Tiara Yachts and BCBSM is a reminder that hiring a service provider to assist with plan administration implicates the continued duty to monitor the provider to protect the plan and its assets. The case also highlights three related and important points that deserve attention in the context of self-funded welfare benefit plan administration.

1. Duty to monitor claims administration. Employers may justifiably expect that specialized TPAs have competence in processing and accurately paying claims. However, even if the TPA passes an initial vetting process regarding the reasonableness of its fees and its ability to service the plan, the employer must continue to assess the TPA’s performance to ensure it is paying claims properly and not wasting plan assets. This issue may be addressed by retaining a competent auditor to review the TPA’s past processing and payment of claims. As plan administrators, employers do not want to find out too late that the TPA, as alleged in the Tiara Yachts case, has been overpaying claims, or worse, improperly making money off the plan based on poor performance.

2. Assessing the adequacy of the provider network. The dispute in Tiara Yachts also highlights the importance of provider networks. In this case, the employer alleged that BCBSM had reimbursed out-of-network providers in excess of the rates established between BCBSM and other Blue Cross entities under the “Host Blue” program. The contention shows the importance of assessing a TPA’s provider network and its pricing of out-of-network claims.

Many employers contract with TPA insurance carriers so that plan participants have access to the TPA’s network of medical providers. Insurance carriers offering a provider network to plans often have arrangements with their contracted providers to be reimbursed at the contracted rate with limits or prohibitions on billing participants for the difference between the provider’s usual charges and the negotiated rate. But when a plan participant obtains services from providers out-of-network, meaning those who do not have contracted rates with the insurance company, the participant likely pays higher cost sharing and may be balanced billed by the provider. Because the sufficiency and scope of the provider network has a direct bearing on the costs to participants, the plan administrator should determine the adequacy of the insurance carrier’s network. This may seem like a daunting task, but there are some available avenues of inquiry.

- Most insurance carriers are governed by federal and state standards for determining the adequacy of their provider networks. For example, insurance carriers offering qualified health plans under the Affordable Care Act are required by Health and Human Services’ (HHS’s) regulations to maintain networks that are sufficient in the number and types of providers to ensure that all services will be accessible without unreasonable delay.

- The regulations impose time and distance standards for accessing various provider types, and a recent rule change requires insurance carriers to meet minimum appointment wait time standards. Although those standards apply to all qualified health plans, insurance carriers may request specific exceptions through submitting a justification with HHS.

- By reviewing the carrier’s requested justification for departing from the network adequacy standards, the employer may get a sense of where it has network adequacy vulnerabilities and whether those might have a bearing on the plan’s coverage of its participants in specific geographic areas.

- Similarly, the employer should also ask the carrier whether it received any deficiency letters or other findings by a state insurance agency regulating the carrier’s network. The information from state and federal agencies may help the employer assess an insurance carrier’s network.

It is unclear whether a network adequacy issue may provide the basis for a fiduciary breach claim in allegedly failing to act prudently in administering the plan. Generally, decisions about plan design or the level of benefits the plan will provide are considered “settlor” functions that do not implicate fiduciary liability. However, the implementation of a plan design is a fiduciary function for which the employer, as the plan administration, may be liable.

As a practical matter, the employer may face uncomfortable complaints from its employees about insufficient coverage when the plan design does not match the representations of the insurance carrier. The strife is obviously increased if the employer faces allegations of imprudence in allowing for a seemingly flawed design. It is best to avoid those issues by investigating the insurance carrier’s network composition before contracting with the carrier.

3. Pursuing legal action against service providers. The duty to monitor includes the plan administrator’s terminating a TPA that fails to provide the promised services for the plan. Because the duty to monitor generally falls under the fiduciary duty of prudence, the plan administrator should also consider, as did Tiara Yachts, whether to sue the service provider to make good any losses to the plan and seek disgorgement of profits from the service provider. This is more than an academic consideration because the employer may be on the hook for any losses to the plan caused by the service provider.

If the service provider acted as a fiduciary of the plan, including by controlling claims administration and payments, as alleged in Tiara Yachts, the employer has equitable remedies under ERISA to seek restitution and disgorgement from the service provider. Those equitable remedies, as discussed by the 6th Circuit, offer some navigational points of hope when dealing with a bad situation because of a service provider’s inadequate performance.

Conclusion

If you have any questions about these latest developments, contact your Fisher Phillips attorney, the author of this Insight, or any attorney in our Employee Benefits and Tax Practice Group. Make sure to sign up for Fisher Phillips Insights to stay up to speed on the latest developments.

Related People

-

- Geoffrey Forney

- Partner