The Tech Employer’s Guide to FLSA Exemptions + Your Compliance Action Plan

Insights

5.20.25

Tech employers have a wide range of workers, which increases the risk of misclassifying employees as exempt from overtime pay. Since violations of the Fair Labor Standards Act (FLSA) can result in significant penalties and costly litigation, it is essential for you to know which employees could potentially qualify for an FLSA exemption – and which ones do not. This Insight will provide you with a summary of common FLSA exemptions that apply to tech employees and an action plan for compliance.

Snapshot of the FLSA’s Rules

You should note that this Insight discusses an employer’s obligations under the federal FLSA only, and you may be subject to additional state or local requirements depending on where you are located.

Unless an employee qualifies for an exemption, the FLSA requires employers to take the following actions for each nonexempt employee:

- pay at least minimum wage ($7.25 per hour);

- pay an overtime premium of at least 1.5 times their “regular rate” of pay after 40 hours of work in a workweek; and

- keep accurate records of hours worked.

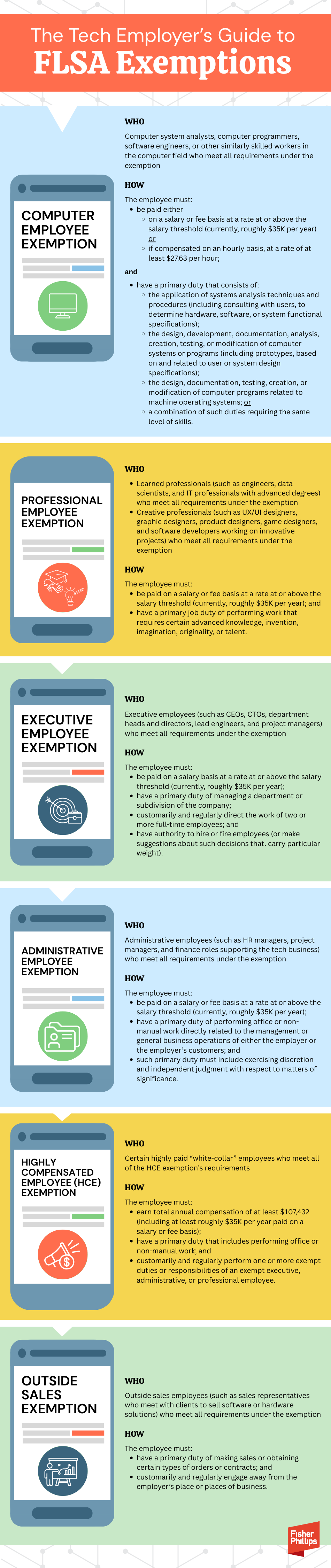

Common Tech Industry Exemptions

The exemption types most common in the tech industry include the “white-collar” exemptions: executive, administrative, and professional (EAP) exemptions, as well as exemptions for outside sales and computer employees. Additionally, some employees may qualify for the “highly compensated employee” (HCE) exemption, which applies a reduced duties test under the EAP exemptions for certain high earners.

Each of the white-collar exemptions applies only to certain employees who meet specific salary and/or duties tests provided in federal regulations. Satisfying these requirements provides an exemption from the FLSA’s minimum wage, overtime pay, and strict recordkeeping requirements. We’ll break down all the details for each exemption type below.

|

DISCLAIMERS: Eligibility for any exemption under the FLSA (and state law, if applicable) is determined on an employee-by-employee basis. This is a fact-specific analysis, and an employee’s job title, job description, or preference – or industry standard or custom – does not determine eligibility for an exemption. Also, don’t forget that states and localities can have higher, stricter, or different wage and hour requirements than those under the FLSA. |

1. Computer Employee Exemption

Salary Test

The employee must be paid either:

- on a salary or fee basis at a rate of at least $684 per week (roughly $35K per year); or

- if compensated on an hourly basis, at a rate of at least $27.63 per hour.

Duties Test

The employee’s primary duty must consist of:

- the application of systems analysis techniques and procedures, including consulting with users, to determine hardware, software, or system functional specifications;

- the design, development, documentation, analysis, creation, testing, or modification of computer systems or programs, including prototypes, based on and related to user or system design specifications;

- the design, documentation, testing, creation, or modification of computer programs related to machine operating systems; or

- a combination of the above duties, the performance of which requires the same level of skills.

The exemption typically does not cover employees whose principal work is to manufacture or repair computer hardware and related equipment, or whose computer-related work otherwise does not fall within one of the necessary primary-duty categories.

Tech Industry Examples

The following types of employees might qualify for the computer employee exemption:

- Computer systems analysts

- Computer programmers

- Software engineers

- Other similar roles

2. Professional Employee Exemption

Salary Test

The employee must be paid on a salary or fee basis at a rate of at least $684 per week roughly $35K per year).

Duties Test

The employee must have a primary duty of performing work requiring either:

- knowledge of an advanced type in a field of science or learning customarily acquired by a prolonged course of specialized intellectual instruction (known as the “learned” professional exemption); or

- invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor (known as the “creative” professional exemption).

Tech Industry Examples

The following types of employees might qualify for the professional employee exemption:

- Engineers, data scientists, and IT professionals with advanced degrees (so long as all requirements under the learned professional exemption are met); or

- UX/UI designers, graphic designers, product designers, game designers, and software developers working on innovative projects (so long as all requirements under the creative professional exemption are met).

3. Executive Exemption

Salary Test

The employee must be paid on a salary basis at a rate of at least $684 per week (roughly $35K per year).

Duties Test

The employee must:

- have a "primary duty" of managing the company or a customarily recognized department or subdivision of the company (see below for examples);

- customarily and regularly direct the work of two or more other full-time employees or their equivalent; and

- have the authority to hire or fire (or make suggestions and recommendations that are given particular weight as to the hiring, firing, advancement, promotion, or any other change of status of other employees).

A wide range of activities may qualify as "management" duties. Below are some of the examples provided by the US Department of Labor.

- Interviewing, selecting, and training employees.

- Setting and adjusting employees' rates of pay and hours of work.

- Planning, apportioning, setting the priority of, and directing employees' work.

- Evaluating employees' productivity and efficiency for purposes of recommending promotions or other changes in their status.

- Handling employee complaints and grievances.

- Disciplining employees when necessary.

- Determining the types of materials, supplies, machinery, equipment, or tools to be used or the merchandise to be bought, stocked, and sold.

- Controlling the flow and distribution of materials or merchandise and supplies.

- Providing for the safety of employees and property.

- Planning and controlling the budget.

- Monitoring or implementing legal compliance measures.

Tech Industry Examples

The following employees might qualify for the executive employee exemption:

- Chief Executive Officers

- Chief Technology Officers

- Department Heads and Directors

- Lead Engineers

- Project Managers

4. Administrative Exemption

Salary Test

The employee must be paid on a salary or fee basis at a rate of at least $684 per week (roughly $35K per year).

Duties Test

The employee must:

- have a “primary duty” of performing office or non-manual work directly related to the management or general business operations (meaning work directly related to assisting with the running or servicing of the business, including, for example, in functional areas such as tax, finance, accounting, marketing, human resources, government relations, computer network, Internet and database administration, legal and regulatory compliance, and similar activities) of either the employer or the employer's customers; and

- as part of that primary duty, exercise discretion and independent judgment with respect to matters of significance (such as formulating or implementing management policies or operating practices if the work performed is highly important or consequential).

Tech Industry Examples

The following employees might qualify for the administrative employee exemption:

- Human Resources Managers,

- Project Managers, and

- Finance roles supporting the tech business.

5. Highly Compensated Employee (HCE) Exemption

Salary Test (Total Annual Compensation Requirement for HCEs)

The employee must earn total annual compensation of at least $107,432 – including at least $684 per week paid on salary or fee basis. The total compensation amount may otherwise consist of commissions, nondiscretionary bonuses, and other nondiscretionary compensation earned during a 52-week period.

"Total annual compensation" does not include payments for medical or life insurance; contributions to retirement plans or other fringe benefit; or credit for board, lodging, or other facilities (such as meals provided by the employer).

|

Time Period for Measuring Total Annual Compensation: An employer can select any 52-week period, such as a calendar year, a fiscal year, or the employee's anniversary year, but a calendar year will apply if the employer fails to select one in advance. If an employee's pay has not reached the threshold by the end of the 52-week period, the employer may, not later than one month later, make a final payment to bring the employee up to the threshold. If the employer does not do so, then the employee's exemption status is determined by the rules under the standard exemption tests. An employee who does not work for the employer for a full year can meet the compensation test if he or she receives a pro rata portion of the threshold based upon the number of weeks the person has been or will be employed. |

Duties Test

If an employee meets the total annual compensation requirement for HCEs, their exempt status will be evaluated under a more relaxed duties test than the EAP exemptions:

- The employee must have a primary duty that includes performing office or non-manual work. No matter how highly paid an employee might be, the exemption will not cover anyone who primarily performs work involving repetitive operations with their hands, physical skill, and energy.

- The employee also must customarily and regularly perform one or more exempt duties or responsibilities of an exempt executive, administrative, or professional employee. The duty must be performed with a frequency that is "greater than occasional" but "less than constant." The DOL says this includes work "normally and recurrently" performed every workweek, and that it does not include isolated or one-time tasks.

6. Outside Sales Exemption

Salary Test

None – the outside sales exemption does not have any salary requirements.

Duties Test

- The employee must have a primary duty of making sales or obtaining orders or contracts for services or for the use of facilities to be paid for by the client or customer.

- The employee also must customarily and regularly engage away from the employer's “place of business” in doing those things. The employer's "place of business" for exemption purposes is sometimes broadly construed, meaning that an employee might be treated as working at an employer’s “place of business” even if the location is not owned or leased by the employer.

|

Limited Application: The outside sales exemption is limited to people who are themselves making sales or who are obtaining orders or contracts. It rarely applies to employees who are delivering things someone else has sold, or to employees who are either promoting sales from a general standpoint or promoting sales to be made by other people. Further, the exemption relates only to outside selling – it seldom includes inside selling, telemarketing, sales made through the mail, sales made through the Internet, and so on. |

Tech Industry Example

Tech sales representatives meeting clients to sell software or hardware solutions might qualify for the outside sales exemption.

Common Pitfalls Tech Employers Must Avoid

- Misclassification Based on Titles Alone. Job titles are not determinative. Titles like “Manager” or “Engineer” don’t automatically make someone exempt – the employee’s actual duties and compensation must meet the criteria for an exemption.

- Failing to Meet Salary Thresholds. Even if an employee’s duties qualify as an exempt, the employee must also meet the applicable salary test requirements.

- Confusion Between Administrative and Production Roles. Administrative exemptions apply to business operations, not to roles directly involved in the “production” of the company’s core goods or services.

- Overlooking State Laws. Some states, such as California and New York, have stricter exemptions – make sure you comply with both federal and state requirements. You may also need to meet local requirements. For example, the salary threshold in New York State for the executive and administrative exemptions varies by location.

Best Practices for FLSA Compliance (and Employee Relations)

- Perform Internal Audits. Prepare a list of all employees you currently treat as exempt, along with their current annual compensation structure and actual job duties. Review and assess whether each employee on this list meets the qualifications for the applicable exemption.

- Consider Your Options for Repairing Misclassifications. This may include making necessary changes to the employee’s primary duties or salary, determining whether any other exemptions may potentially be available, or converting the employee to non-exempt status. Work with counsel to understand your options and how to execute them.

- Personalize Communications. Reclassifying an employee as non-exempt can have a big impact on an employee’s status, morale, and benefits. How you communicate the message is critical, and you should strive to position the change as a benefit to the employee.

- Conduct Regular Reviews. Job duties and salary thresholds should be reviewed regularly to ensure compliance with changing FLSA and state regulations. Each year you should review your practices and ensure job descriptions are accurate and up to date. You should also consider arbitration agreements and class action waivers, and whether any other written materials, like your employee handbook and offer letters, should be revised. Check out our Wage and Hour Insights page for the latest compliance tips.

Conclusion

Wage and hour issues are often more complicated than they appear, especially as your business continues to grow. We recommend you consult legal counsel with experience in the tech industry to assist with compliance issues. Your Fisher Phillips attorney will be happy to assist. If you have questions, contact your Fisher Phillips attorney, the authors of this Insight, any member of our Wage and Hour Practice Group, or any attorney on our Tech Industry Team.

We will continue to monitor workplace law developments as they apply to employers in the tech industry, so make sure you are subscribed to Fisher Phillips’ Insights System to get the most up-to-date information directly to your inbox.

Related People

-

- Brett P. Owens

- Partner