The U.S. Department of Labor just overhauled OSHA’s penalty guidelines to give small employers and safety-conscious businesses a financial break. Effective immediately, the new policy:

- significantly increases penalty reductions for small businesses

- offers new incentives for employers who quickly fix hazards

- rewards companies with clean safety records

However, the agency still made clear in Monday’s announcement that it will maintain enforcement authority and hold employers accountable if they maintain unsafe work conditions, so yesterday’s news isn’t a get-out-of-jail-free card. Here’s what employers need to know, and five steps you can take to position yourself for this new development.

What Changed

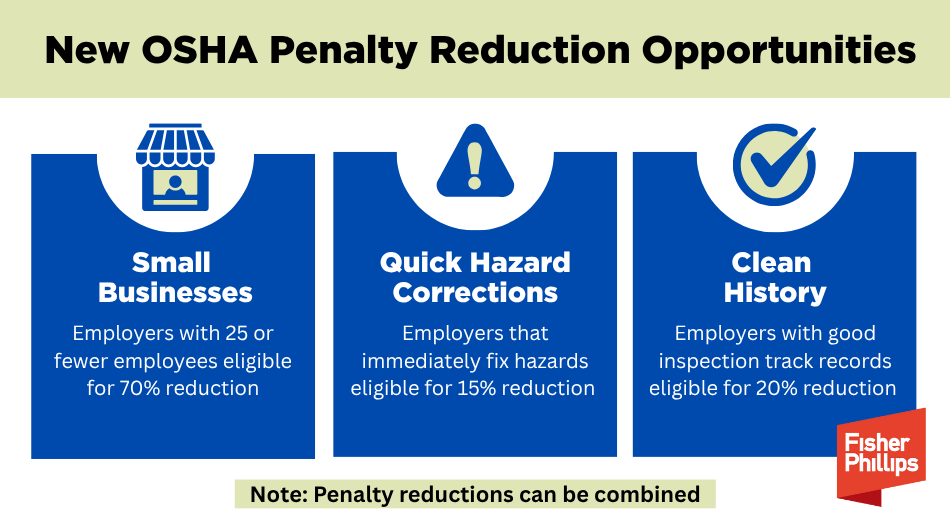

The new policy, issued July 14, updates Chapter 6 of OSHA’s Field Operations Manual (“Penalties and Debt Collection”) and includes three major penalty reduction opportunities:

- Small Business Relief

Employers with 25 or fewer employees are now eligible for a 70% penalty reduction (up from the previous cap of 10 employees).

- Quick Hazard Correction Incentive

A new 15% reduction is available for employers that immediately fix a hazard identified during an inspection.

- Clean History Credit

Employers are now eligible for a 20% reduction if:

-

- They’ve never been inspected by OSHA or a state OSHA plan; or

- They’ve been inspected in the past five years but had no serious, willful, repeat, or failure-to-abate violations.

These reductions can be combined, meaning small, proactive, and historically compliant employers could see penalties reduced by over 80% in some cases.

When is this Effective?

The new policy applies only to penalties issued on or after July 14, 2025.

- Open investigations that haven’t yet resulted in penalties will be assessed under the new framework.

- Penalties issued before this date remain governed by the old structure.

Why It Matters

This marks one of the most employer-friendly shifts in OSHA’s enforcement approach in years, particularly for small businesses:

- Real savings for small firms. A 70% reduction in proposed penalties can make a critical difference for smaller employers navigating narrow margins and limited legal resources.

- Incentivizing immediate fixes. By offering a quick-fix credit, OSHA is clearly prioritizing real-time hazard abatement over drawn-out penalty negotiations.

- Clean history pays off. Employers with no OSHA history or a history with nothing more than other-than-serious citations now have a concrete reason to invest in preventative compliance programs.

5 Steps Employers Should Consider Now

To take full advantage of the new policy, businesses – especially smaller employers – should consider taking these five steps:

1. Reassess workforce size regularly.

Confirm whether your business qualifies for the ≤25 employee threshold. This count may fluctuate throughout the year, so monitor staffing closely.

2. Create a “quick fix” response plan.

Train supervisors to act fast on any hazard identified by OSHA or internal audits. Immediate abatement must be clearly documented to qualify for the 15% reduction.

3. Review inspection history.

If your business has avoided OSHA violations over the past five years, or has never been inspected, you could be entitled to a 20% discount. Prepare documentation as necessary to prove your compliance.

4. Strengthen compliance systems.

Use this moment as an opportunity to refresh workplace safety protocols, enhance training, and document hazard mitigation efforts. Compliance has never before been so valuable.

5. Prepare to negotiate.

If facing an OSHA citation, work with your FP Workplace Safety counsel to leverage your eligibility for reductions, especially if you’re correcting hazards proactively and operating in good faith.

Key Final Points

- State plan adoption may vary. Not all states will implement these changes immediately. Employers in state-plan jurisdictions should check for localized guidance or timelines.

- Discretion still matters. OSHA can deny reductions in egregious or repeat violation cases. You will want to maintain clear records to show good-faith efforts and a culture of safety.

- Watch broader trends. This update reflects a broader federal effort to balance enforcement with regulatory flexibility for smaller businesses. Future changes may follow a similar model.

Conclusion

If you have any questions about OSHA compliance, contact the authors of this Insight, your Fisher Phillips attorney, or any attorney on our Workplace Safety team. Make sure you are subscribed to Fisher Phillips’ Insight System to get the most up-to-date information.