Open enrollment season can put a spotlight on the many complex rules applicable to employer-sponsored health and welfare plans. As you announce your benefit offerings for the upcoming plan year and tirelessly work to inform employees of their options, answer their questions, and handle the administration on the back end, you must be aware of key laws impacting annual open enrollment in the workplace. We’ll cover five legal considerations and give you employer takeaways to help you stay compliant during your organization’s open enrollment period.

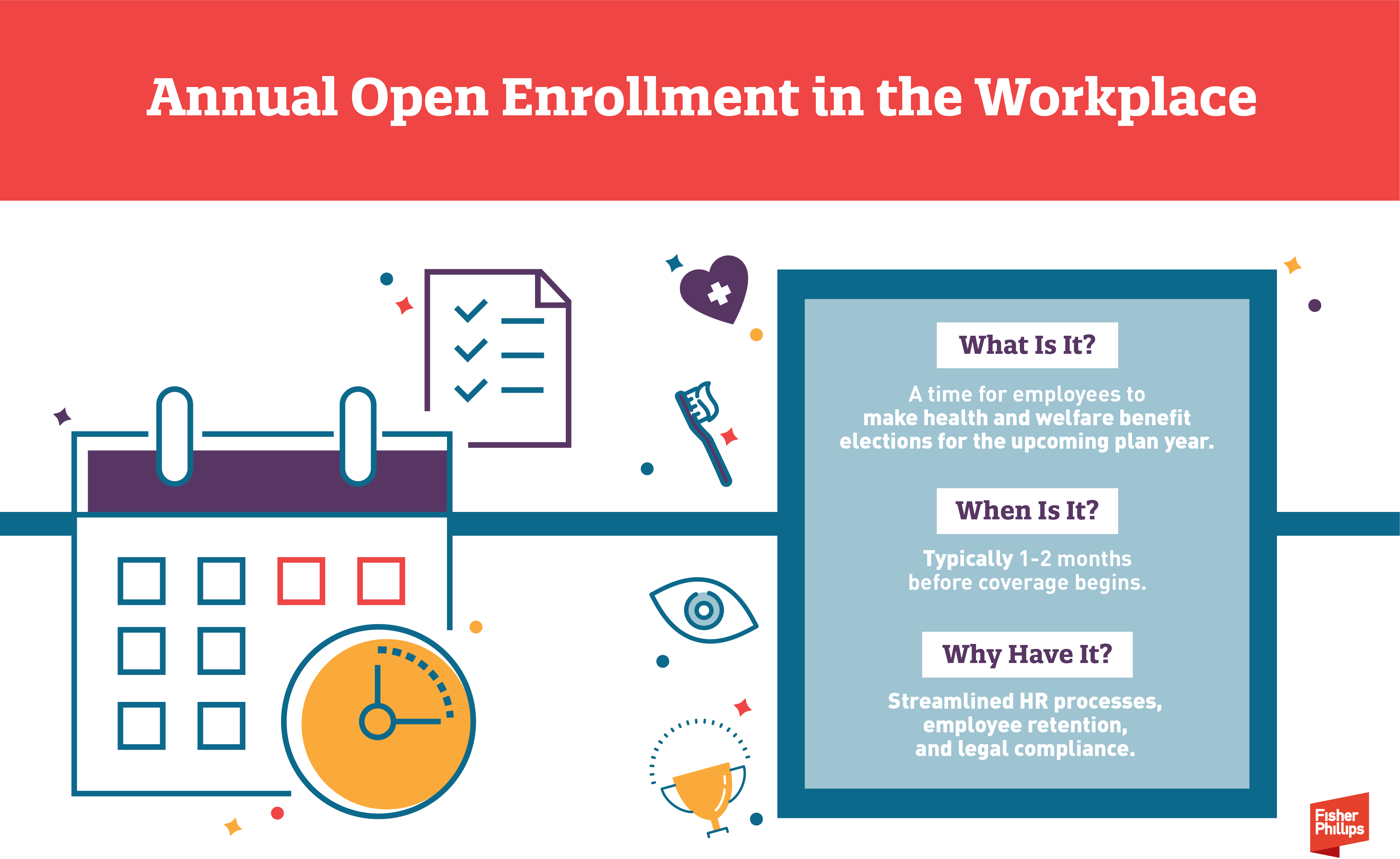

Annual Open Enrollment in the Workplace

- What Is It? An annual open enrollment period allows eligible employees to make choices for the upcoming plan year regarding employer-sponsored health and welfare benefits – such as health, dental, vision, life, or other voluntary insurance coverage for themselves and their eligible dependents. The annual open enrollment period contrasts with initial enrollment (at the time of hire or when an employee first becomes eligible to participate) or special enrollment periods (such as when an employee experiences a specific event that entitles them to make mid-year changes to their benefit elections).

- When Is It? The open enrollment period typically launches a month or two before coverage begins and lasts for roughly two to four weeks. For example, employers that operate their group health plans on a calendar-year basis often hold open enrollment in October or November before coverage begins on January 1.

- Why Have It? Designating a specific timeframe for all employees to make their benefits selections not only reduces the administrative burden on HR teams but also can be necessary for compliance purposes.

- Any Tips? Last year, Fisher Phillips covered how employers and HR teams can best prepare for open enrollment season and ensure a smooth process for everyone in your organization. This year’s Insight will focus on a handful of key compliance issues to consider as you gear up for your annual open enrollment period.

5 Legal Considerations + Employer Takeaways for Your Annual Open Enrollment Period

1. Employer Mandate under the Affordable Care Act (ACA)

The ACA requires applicable large employers (ALEs) to offer qualifying health coverage to their full-time employees (and their dependents) or potentially be subject to Internal Revenue Service (IRS) penalties. Your annual open enrollment period plays a critical role here because:

- The IRS will not treat an ALE as having made an “offer of coverage” to an employee unless it provides the employee an effective opportunity to enroll in the coverage (or to decline that coverage) at least once for each plan year. (Whether the health coverage is “affordable” and provides “minimum value” under the ACA is a separate determination).

- Whether an “effective opportunity” is provided depends on all the relevant facts and circumstances, including adequacy of notice of the availability of the offer of coverage, the period of time during which the offer of coverage may be accepted, and any other conditions on the offer.

- The same is true for determining whether the ALE made an offer of coverage to the employee’s dependents, which includes qualifying children under age 26 (but does not include spouses) under the employer mandate rules.

- While the IRS permits coverage elections that roll over from year to year unless the employee affirmatively elects to opt out of the plan to count as “offers of coverage,” holding an annual open enrollment period is still important to allow employees to make changes to their elections from a prior year.

Employer Takeaways

If you are an ALE, make sure that you give eligible employees an “effective opportunity” to elect or decline health coverage (or to make changes to elections rolled over from the prior year) for themselves and their qualifying dependent children. If you are not an ALE, you should check (as applicable) whether your health insurance carrier or the terms of a union agreement require you to provide an open enrollment period at any certain time.

2. Cafeteria Plans under the Internal Revenue Code (IRC)

A “cafeteria plan” under IRC Section 125 permits employees to pay for health and welfare benefit costs (such as the employee’s portion of health insurance premiums) on a pre-tax salary reduction basis. For a cafeteria plan to keep its tax-favored status, participants’ elections generally must be made on a prospective basis and remain irrevocable during the plan year (subject to limited exceptions as permitted by the IRS and the plan document). Similar IRS rules apply to other employer-sponsored benefits, such as health flexible spending accounts.

Employer Takeaways

Here’s how the cafeteria plan rules impact your annual open enrollment period:

- Election Timing. Cafeteria plan elections must be made prior to the start of the plan year. Beyond that, you may choose the open enrollment timeframe that works best for your organization. Remember to allow enough time between the end of the open enrollment period and the start of the new plan year to process enrollments and handle related administrative tasks.

- Election Changes (Prior to Plan Year). If an employee asks to change their election after open enrollment ends but before the plan year begins, you may permit them to do so – but keep in mind that this will create a precedent for future employees making similar requests.

- Election Structure. You may require affirmative elections each year or set up default or rolling elections, but in any event the election method and irrevocability rules should be clearly communicated to employees and explained in the plan materials. And keep in mind the ACA considerations discussed above.

3. IRS Limits for Account-Based Plans

Account-based health and welfare plans allow employees to set aside pre-tax dollars for certain qualifying expenses. The IRS sets annual limits related to those accounts, and while employers may choose to establish lower limits, many want to offer their employees maximum tax savings. Here are a few examples:

- Health FSAs. For 2024, the IRS permits an employee to contribute up to $3,200 to a health flexible spending account, and the maximum carryover amount (for plans that permit employees to carry over unused amounts from one plan year to the next) is $640. The IRS has not yet announced the limits for 2025, so stay tuned for updates.

- Health Savings Accounts (HSAs). The IRS sets inflation-adjusted amounts for HSAs, including an annual contribution limitation as well deductible requirements and out-of-pocket maximums for high-deductible health plans. Earlier this year, the IRS announced these limits for 2025, which you can find here.

Employer Takeaways

During the open enrollment process, you should:

- confirm that all materials (including employee communications) are updated for annual plan limits (if applicable, make sure to factor in any employer contribution amounts); and

- clearly communicate which plans are subject to a “use-it-or-lose-it” rule (such as health FSAs or dependent care account programs) and, if applicable, information on carryover amounts or grace periods.

4. Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) and FMLA

When an employer is required to offer a “qualified beneficiary” COBRA continuation coverage, it generally needs only to offer continuation of the same coverage the individual was receiving prior to the qualifying event. However, during the employer’s open enrollment period for its active employees, it must make the same open enrollment period rights, such as an opportunity to switch to another plan or to add or eliminate coverage of family members, available to each qualified beneficiary receiving COBRA continuation coverage.

Similar rules apply to employees on leave protected by the Family and Medical Leave Act (FMLA). For example, if your group health plan offers an annual enrollment period to active employees, then any employee on FMLA leave when open enrollment is offered must be given an opportunity to make election changes on the same basis as other employees.

Employer Takeaways

Remember that your annual open enrollment period is not just for your employees who are actively working and can even impact individuals who are no longer (or who never were) employed by you. Determine whether any other individuals, such as qualified beneficiaries receiving COBRA continuation coverage or employees out on FMLA leave, are legally entitled to participate in the process and give them an opportunity to do so as if they were active employees.

5. Required Disclosures under ERISA and Other Laws

The Employee Retirement Income Security Act (ERISA) provides basic disclosure requirements for employee benefit plans, and a wide range of other laws (such as COBRA, the ACA, and the Health Insurance Portability and Accountability Act (HIPAA), and many others) provide additional disclosure requirements for group health plans.

Employers sponsoring group health plans must ensure that all required disclosures are timely distributed to the individuals entitled to receive them – including plan participants, beneficiaries, all eligible employees, or all employees regardless of plan eligibility or participation, depending on the specific disclosure. The disclosure requirements that apply to you depends on a variety of factors, such as the types of benefits you offer and whether your plan is fully insured or self-funded.

Employer Takeaways

Here’s how your open enrollment period comes into play:

- Some disclosures must be provided with enrollment materials, such as a Summary of Benefits of Coverage. Determine what disclosures must be provided during open enrollment and make sure they are timely distributed as required. This may involve coordinating with your insurance carriers or other plan providers (as applicable).

- Other disclosures must be provided within a short timeframe after coverage begins or upon request – and you may be more likely to receive these requests during open enrollment. For example, a summary plan description must be provided within 90 days after a participant becomes covered by the plan or within 30 days after a participant or beneficiary requests a copy. Consider taking a proactive approach by ensuring, before open enrollment begins, that you are properly maintaining and updating all required disclosures in this category.

- Open enrollment can be a good time to satisfy other disclosure requirements – even if delivery is not necessarily required at this time or upon request – and review your company’s policies, procedures, and plan documents to ensure that they updated for any changes in plan design or legal compliance.

Conclusion

If you have questions about open enrollment compliance, strategies, or best practices, feel free to reach out to your Fisher Phillips attorney, the author of this Insight, or any attorney in our Employee Benefits and Tax Practice Group. We will continue to provide tips, guidance, and updates on employee benefits and other workplace law topics, so make sure you are subscribed to Fisher Phillips’ Insight System to get the most up-to-date information directly to your inbox.