New Final Rules on Texas Education Savings Account Program: Top Takeaways + 3 Action Steps for Private Schools

Insights

12.08.25

Texas private schools now have more important details on the Texas Education Freedom Accounts Program (TEFA), thanks to new rules that impact private schools and their communities. The final rules, which were announced November 25 by Acting Texas Comptroller Kelly Hancock, reflect significant public input and clarify many of the questions raised by the state’s new school choice law – though some remain unanswered. We’ll give you the top takeaways and three action steps for private schools.

Quick Background

Governor Greg Abbott signed a bill into law on May 3 that establishes an education savings account program designed to provide families in the state with additional educational options to support the needs of their children by funding approved education-related expenses. You can read our in-depth coverage of SB 2 here.

As authorized by SB 2, the Comptroller’s office issued proposed rules in August and finalized them after considering more than 300 written public comments. The final rules (available here) provide important details and clarity regarding the TEFA program.

Top 5 Takeaways for Private Schools: Key Dates, Administrative Procedures, and More

In this section, we’ll cover the top takeaways from the new final rules that impact schools and their operations. (In a later section, we’ll cover the top takeaways that impact broader school communities).

1. Key Details on Application Process and Timing

- Schools can apply to participate in the program starting December 9, 2025.

- Parents can begin applying to participate in the program on February 4, 2026. The application process requires parents to submit a Comptroller-approved application during the designated application period. The rules clarify that all applicants, including those on the waitlist, must update or supplement their application each year, rather than reapplying from scratch.

2. Clarity on Program Administration and Funding

- Funding and Disbursement: Accounts are funded in installments (at least quarterly), and the Comptroller will make the first payment by July 1 (the Comptroller declined to extend the initial funding date, despite comments that it would “operate as a de facto application deadline”). Verification of eligibility and enrollment is required before funds are released to participating families. Unused funds roll over to the next year if the child remains eligible.

- Midyear Departures: The Comptroller acknowledged that private contracts between families and private schools are outside the scope of the law establishing TEFA, meaning that private schools can enforce financial obligations in enrollment contracts in accordance with their standard policies and procedures.

- Assessments: Schools must administer nationally recognized norm-referenced tests for students in grades 3-12. The final rules make it clear that TEFA-participating parents – and not the school – must provide the results to the certified educational assistance organization or authorize and instruct the administrator of the assessment to provide the results to the certified educational assistance organization by the end of the academic year.

- Participant Suspension and Removal: Participants – both families and schools – may be suspended from TEFA for program violations and permanently barred from TEFA participation if they fail to take sufficient corrective action after notice of a TEFA violation. Participants may appeal these decisions to the Comptroller, who has final say over such matters.

- Homeschool Funding and Non-Participating Private Schools: Homeschool funding is available only to children who are not enrolled in any public or approved private school. Enrollment in a non-participating private school does not qualify a child for TEFA funds under the homeschool category.

- Financial Aid and TEFA: It remains unclear whether the state will notify participating schools of the amount of a TEFA award received by a participating family. Schools may want to work with their legal counsel to require disclosure, possibly as part of the enrollment contract. Schools also have flexibility to determine how their financial aid programs and TEFA intersect. It is important to ensure that your enrollment contract contains clear language addressing TEFA.

3. More on School Autonomy, Auditing, and Non-Discrimination

- School Autonomy: The rules reinforce that participation in the program does not make a school a state actor or recipient of federal financial assistance. State agencies or officials cannot impose requirements contrary to a school’s religious or institutional values, curriculum, or admissions standards. However, this does not preclude future changes in the TEFA rules or changes by the Texas state legislature.

- Auditing Program Transactions: The Comptroller has stated that the program’s auditing requirement will not include schools’ financial aid awards and other transactions not related to the program. However, “program transaction” is not specifically defined in the rules, leaving ambiguity over the exact scope of what is going to be audited.

- Non-Discrimination: TEFA participation does not modify a private school’s existing non-discrimination and accommodation obligations.

- Vaccination Exemptions: Private schools that participate in TEFA are, as of now, not required to accept vaccine exemptions. However, there is an attorney general opinion pending on this very subject, which may impact this requirement. Schools should monitor developments in this area and consult legal counsel as needed.

4. Updates to Key Terms

The final rules update the definitions of these key terms:

- “Campus” now includes virtual campuses, and the “reasonably contiguous geographic area” requirement of the original proposed rules has been eliminated.

- “Education service provider” is now defined to only include approved, accredited private schools and approved pre-k and kindergarten providers – omitting tutors, therapists, and teaching services.

- “Instructional materials” are defined as printed or digital materials, supplies, or equipment that contribute to a student’s learning process.

5. Clarity on Accreditation and Two-Year Operation Requirement

Private schools must be accredited by a TEPSAC- or TEA-recognized body, have operated a campus (in or out of state) for at least two years, and have a location in Texas. The rules clarify that if a private school operates as a single legal entity with multiple campuses, the school may satisfy the two-year operation requirement with any one of its campuses, regardless of whether that campus is located in Texas or another state.

|

3 Action Steps for Schools 1. Decide whether participating in TEFA aligns with your school’s goals, mission, and values now that the school can fully assess the rules. We recommend this include Board involvement given TEFA participation includes, among other things, the school’s mission, values, and fiscal matters. 2. If participating in TEFA, determine how your financial aid program and TEFA funds will operate with respect to one another. 3. Revise your enrollment agreements and applications. For participating schools, this includes, among other things, specifying how TEFA dollars will impact financial aid awards and whether the family remains responsible for the full year’s tuition. For schools not planning to participate, consider language that provides notice so families do not apply in reliance on receiving a TEFA award. |

Top 5 Takeaways Related to Students

In addition to the above, the new final rules provide important details that will impact your school community and application process. Here are the key points you should know:

1. Eligibility Tied to Year When Funds Are Used

A child is eligible to participate in TEFA if they are:

- eligible to attend a Texas public school (or eligible to enroll in a free pre-kindergarten program);

- not currently enrolled in a public school during their participation in TEFA;

- a US citizen or national, or lawfully admitted into the US;

- not yet graduated from high school; and

- not declared ineligible under the program.

The rules clarify that eligibility criteria are tied to the year in which the child would use program funds, rather than the child’s current situation at the time of application to the program.

2. Prioritization Will Look at a Family’s Adjusted Gross Income

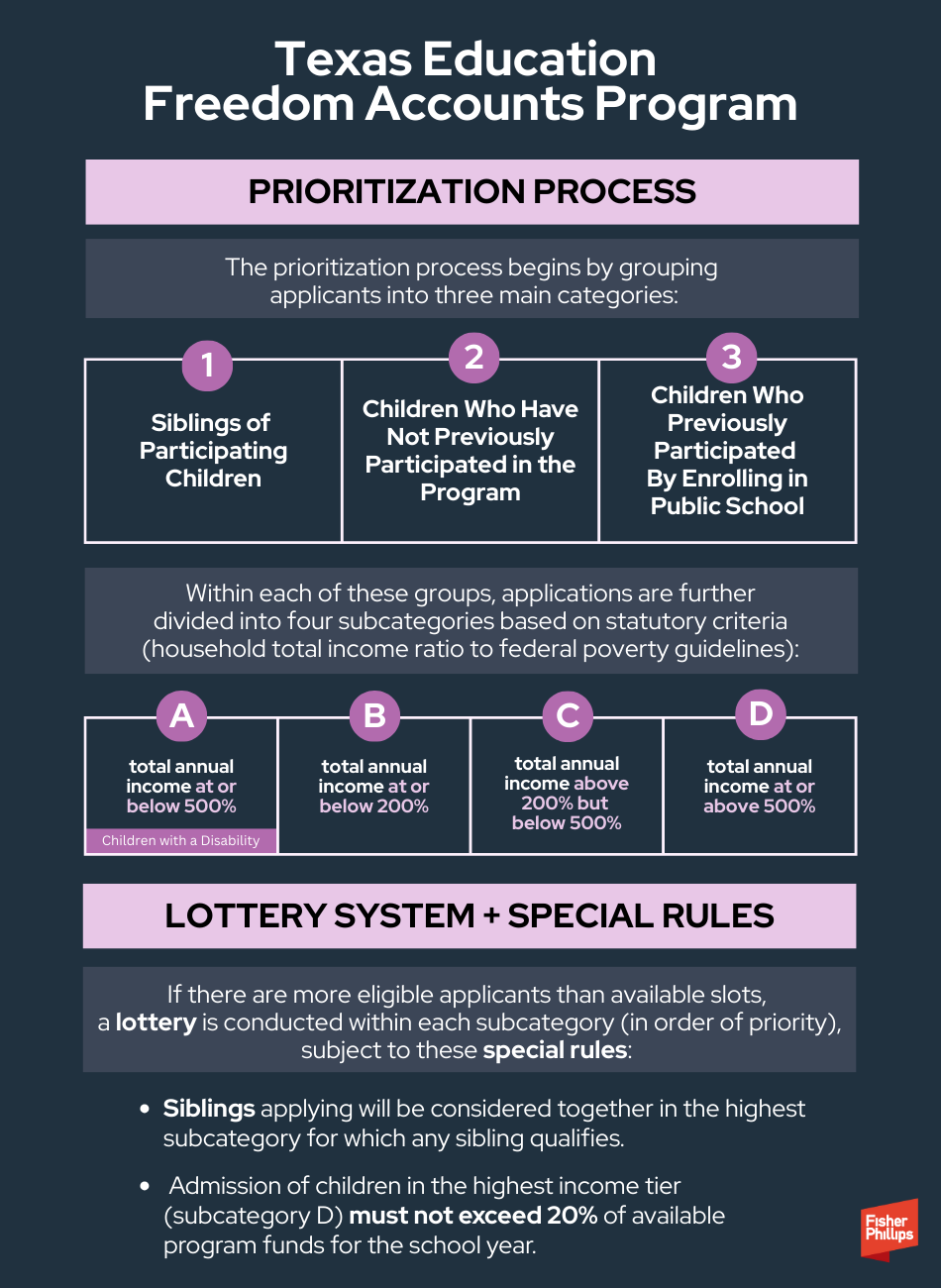

If more eligible applications are received than available slots during an application period, the applications will be subject to a prioritization rules (as shown in the graphic below). The new rules clarify that “total annual income” for purposes of prioritization determinations means a family’s adjusted gross income.

3. Children with Disabilities: IEP Required for Additional Funding – But Not for Prioritization

- Proof for Prioritization: The rules allow for multiple forms of documentation to establish a child’s disability for purposes of prioritization of funding, including evidence from licensed professionals, out-of-state IEPs, or a Full and Individual Initial Evaluation (FIIE). However, to qualify for additional TEFA funding up to $30,000, a child with a disability must submit an in-state IEP.

- Funding for Disabilities: Additional funding for children with disabilities is based on the amount that the local school district would have received from the state for that child, depending on the child’s IEP and the state’s funding rules for special education. Any TEFA disbursements for children with disabilities are capped at $30,000 annually. The rules clarify that the $2,000 cap (and not the $30,000 cap) applies to homeschooled students, even if they have a disability.

4. Pre-K and Kindergarten Providers Not Subject to $2K Cap

The rules clarify that the $2,000 cap does not apply to students enrolled in approved pre-k or kindergarten providers.

5. Conditions on Technology Expenses, No Reimbursements

Program funds may be used for tuition and fees, uniforms, instructional materials (including digital), assessment costs, tutoring, educational therapies, transportation, technology (subject to a 10% cap of the total amount allocated to a participating child’s TEFA account), and school meals. The rules clarify that technology expenses must be required by an education service provider (which includes private schools) or prescribed by a physician.

|

No Guidance on After-Care or Extracurriculars. While there is no guidance on whether after-care or extracurricular activities can be paid for out of TEFA funds, these items are not included on the list of approved expenses, and we do not expect that they will be permitted. |

The rules explicitly prohibit reimbursements. All purchases made with TEFA funds must be made through a Comptroller-approved payment system.

Conclusion

The final rules for TEFA provide detailed guidance for families, providers, and administrators. They reflect legislative intent, public feedback, and practical considerations for program implementation. However, they do not address every question or circumstance that schools may confront as they think about whether to participate.

Please consult your Fisher Phillips attorney, the authors of this Insight, any attorney on our Education Team, or any attorney in our Texas offices to obtain practical advice and guidance on how to navigate TEFA. Please also make sure you are subscribed to Fisher Phillips’ Insight System to get the most up-to-date information.

Related People

-

- Brian Guerinot

- Associate

-

- Kristin L. Smith

- Partner, Co-chair K-12 Institutions