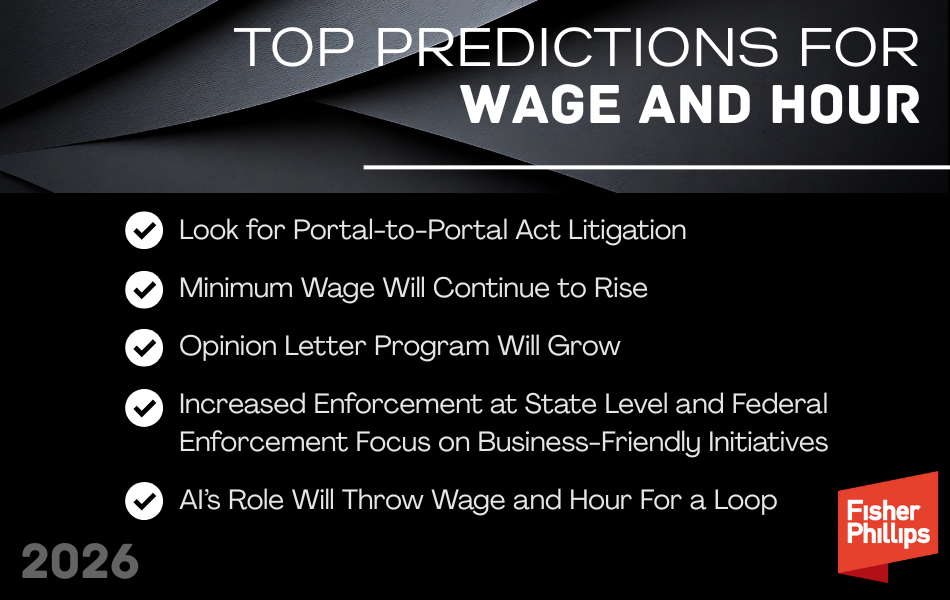

FP’s Top 2026 Predictions for Wage and Hour

Insights

1.06.26

Our Wage and Hour thought leaders have pulled together their top predictions for the new year so that employers can get a head start to 2026. If you want more, register for our FP Workplace Law Forecast Webinar here.

Look for Portal-to-Portal Act Litigation

We expect to see a substantial uptick in litigation involving employees who undergo security, wait time, and walk time under the Portal-to-Portal Act (PTPA). Generally, the federal law clarifies that employees don’t have to be compensated for time spent doing tasks before or after the workday (like clocking out) so long as the task isn’t “integral” to the employee’s job.

While not all state wage statutes explicitly incorporate the PTPA, the last five years have seen numerous courts clarify whether it applies to state laws – or provides broader coverage. Major retailers and entities with warehouse presences have faced the most heat. We expect some states will try to clarify whether they follow the PTPA in 2026.

Minimum Wage Will Continue to Rise

Several states will increase their minimum wages in 2026 – well above the $15 range in some locations – particularly in the Midwest. For example, DC’s minimum will be more than double the federal requirement at $18.00, and California’s minimum will go up to $16.90. We expect that increases will remain local and at the state level, and that the federal government will be unable to agree on a measure to raise the federal minimum from it’s current $7.25.

Opinion Letter Program Will Grow

As part of its compliance assistance efforts, the DOL expanded its opinion letter program in 2025, encouraging businesses to submit their questions about how various laws apply to their specific working situations. Already, the Wage Division has released letters clarifying whether “front of house” oyster shuckers can participate in a tip pool, as well as whether a hotel restaurant and related members club were joint employers for overtime purposes.

The compliance assistance effort is likely to continue to grow throughout 2026 and companies should expect more guidance materials from the DOL in the coming year.

Increased Enforcement at State Level and Federal Enforcement Focus on Business-Friendly Initiatives

States with robust wage and hour and wage payment laws (e.g. CA, IL, NJ, NY, WA), will continue to aggressively enforce their laws during a period when DOL enforcement activities may decline in part, due to a reduction in the number of investigators, as well as a its general policy approach.

We expect the federal DOL’s business-friendly posture will continue throughout 2026.

Last year, saw the DOL step back from issuing liquidated damages. It also revived the Payroll Audit Independent Determination (PAID) program, which allows employers to self-audit and resolve certain FLSA violations with the wage division’s assistance. Employers should keep in mind that resolution of wage and hour issues with DOL does not cut off employee rights under other state or local laws, so expect plaintiffs to seek their recovery at that level.

AI’s Role Will Throw Wage and Hour For a Loop

Artificial intelligence technology will have a substantial impact on wage and hour issues, including FLSA exemption status. If AI ends up substituting “independent judgment” under the administrative employee exemption, or the introduction of robots and AI reduces headcount so that an individual is no longer supervising two or more full-time employees, workers could lose eligibility for the executive employee OT exemption.

|

Want More?

|

Conclusion

We will continue to monitor developments related to all aspects of wage and hour law. Make sure you are subscribed to Fisher Phillips’ Insight System to get the most up-to-date information. If you have questions, contact your Fisher Phillips attorney, the authors of this Insight, or any member of our Wage and Hour Team.

Related People

-

- Kathleen McLeod Caminiti

- Partner and Co-Chair, Wage and Hour Practice Group

-

- J. Hagood Tighe

- Partner and Co-Chair, Wage and Hour Practice Group