Florida’s Mandatory E-Verify Law: A Compliance Plan for Covered Employers

Insights

8.14.25

Employers in Florida need to comply with the state’s stricter employment verification obligations, or they could face serious consequences. Since 2023, private businesses with at least 25 employees have been required to use the federal E-Verify system to confirm employment eligibility for new hires. Although the law garnered considerable media attention when it was first enacted, many employers may not know the state conducts compliance audits and imposes penalties for violations. Here’s how employers can be prepared and create a plan to mitigate legal and financial risks.

What is E-Verify?

- Work Authorization Verification: With few exceptions, all employers are required to complete a Form I-9 employment verification for new hires based in the US (and to reverify in certain circumstances). E-Verify is a free, web-based federal system that allows enrolled employers to confirm employment eligibility by electronically matching information provided on the Form I-9 against government records. While E-Verify is voluntary for most employers, it is mandatory for certain federal contractors and in some states.

- Federal-Level Fines: Regardless of whether an employer uses E-Verify, federal law imposes stiff penalties on employers that do not comply with I-9 employment verification obligations. Mistakes on I-9s can cost hundreds to thousands of dollars and knowingly hiring unauthorized workers can result in even higher penalties and possible jail time.

- E-Verify Goals: The purpose of E-Verify is to help employers stay compliant with federal employment and immigration regulations, though there are pros and cons to using the electronic system when it’s voluntary. So, when E-Verify is not mandated, you should carefully review your I-9 compliance options with counsel.

What Does Florida Mandate?

- Covered Employers: Florida imposes strict immigration-related requirements on employers and workers, including a requirement that private employers with at least 25 employees use the E-Verify system to confirm employment eligibility for all new hires. Public employers in Florida also must comply, along with contractors and subcontractors working on public contracts, who were already subject to an E-Verify mandate prior to this law.

- State-Level Penalties: Employers face a $1,000 daily fine for repeat violations (three times in any 24-month period) until compliance is achieved. They could also see their business license suspended. Additionally, employers found to have knowingly hired unauthorized workers may face probationary oversight, mandatory quarterly reporting, and even permanent revocation of their business licenses. These penalties increase with the number of unauthorized employees and for repeat violations.

Florida’s Audit Process

You should note that certain state agencies have the authority to audit employers suspected of noncompliance, including Florida’s Department of Economic Opportunity (DEO) and Department of Law Enforcement (FDLE). The audit process generally includes:

- A notice of inspection indicating that the employer is under review.

- A request for documentation, such as E-Verify records, I-9 forms, and proof of annual certification.

- A 30-day window to correct any deficiencies after the employer has been notified of a violation.

Certain repeat violations can result in fines of up to $1,000 per day and the potential suspension or revocation of a state business license.

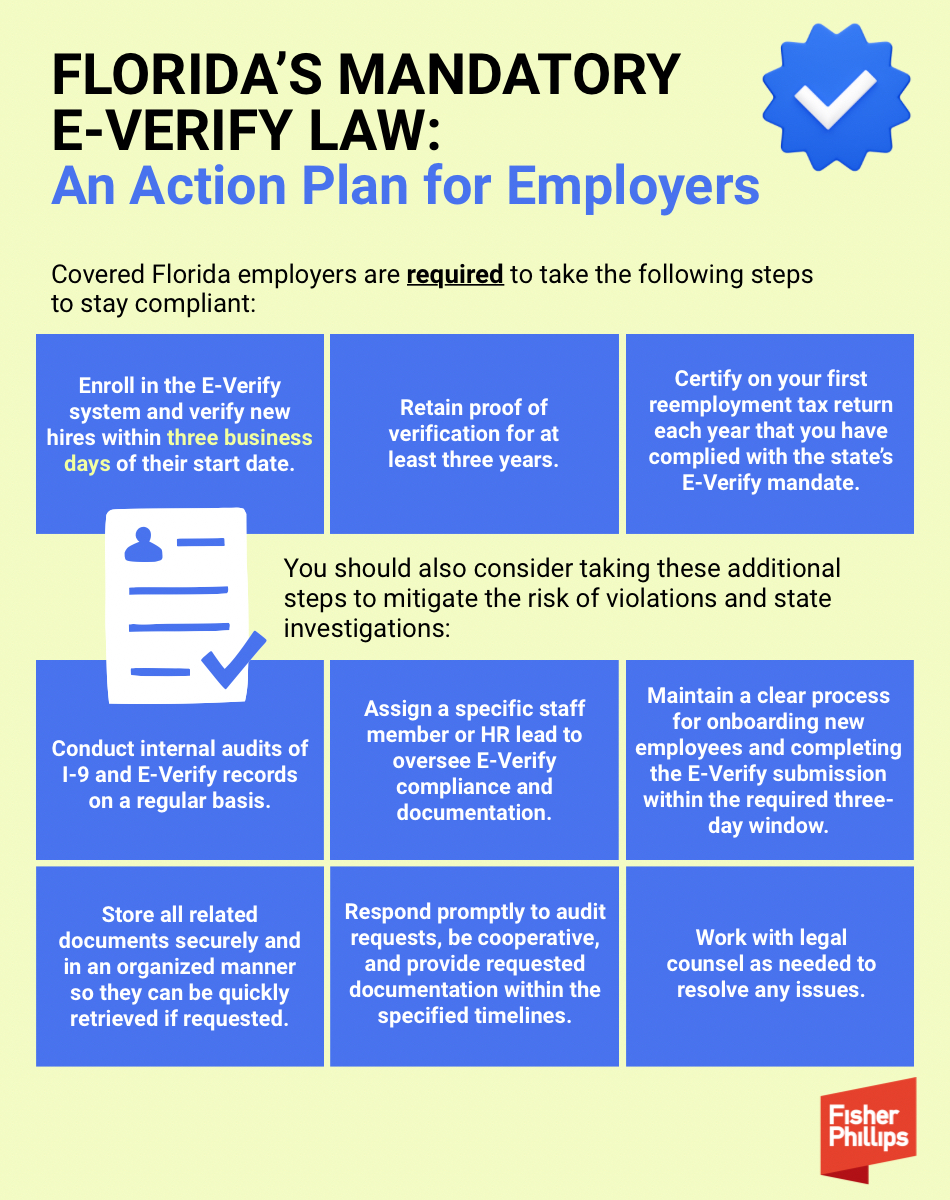

An Action Plan for Florida Employers

Covered Florida employers are required to take the following steps to stay compliant:

- Enroll in the E-Verify system and verify new hires within three business days of their start date.

- Retain proof of verification for at least three years.

- Certify on your first reemployment tax return each year that you have complied with the state’s E-Verify mandate.

You should also consider taking these additional steps to mitigate the risk of violations and state investigations:

- Conduct internal audits of I-9 and E-Verify records on a regular basis.

- Assign a specific staff member or HR lead to oversee E-Verify compliance and documentation.

- Maintain a clear process for onboarding new employees and completing the E-Verify submission within the required three-day window.

- Store all related documents securely and in an organized manner so they can be quickly retrieved if requested.

- Respond promptly to audit requests, be cooperative, and provide requested documentation within the specified timelines.

- Work with legal counsel as needed to resolve any issues.

Conclusion

We will continue to monitor E-Verify and I-9 Form developments and will provide guidance accordingly. Make sure you are subscribed to Fisher Phillips’ Insight System to get the most up-to-date information delivered to your inbox. If you have further questions, contact your Fisher Phillips attorney, the authors of this Insight, or any attorney in our Florida offices or Immigration Practice Group.

Related People

-

- Brian J. Coughlin

- Partner

-

- Garrett S. Kamen

- Partner

-

- Connie Yang

- Partner