The California Legislature just wrapped up its work for the year, and now all eyes turn to Governor Newsom, who has until October 12 to sign or veto each of the bills sent to his desk. Any bills signed into law will take effect on January 1, 2026. What are the top bills that employers should be monitoring?

12 Workplace Bills That Await the Governor’s Signature or Veto

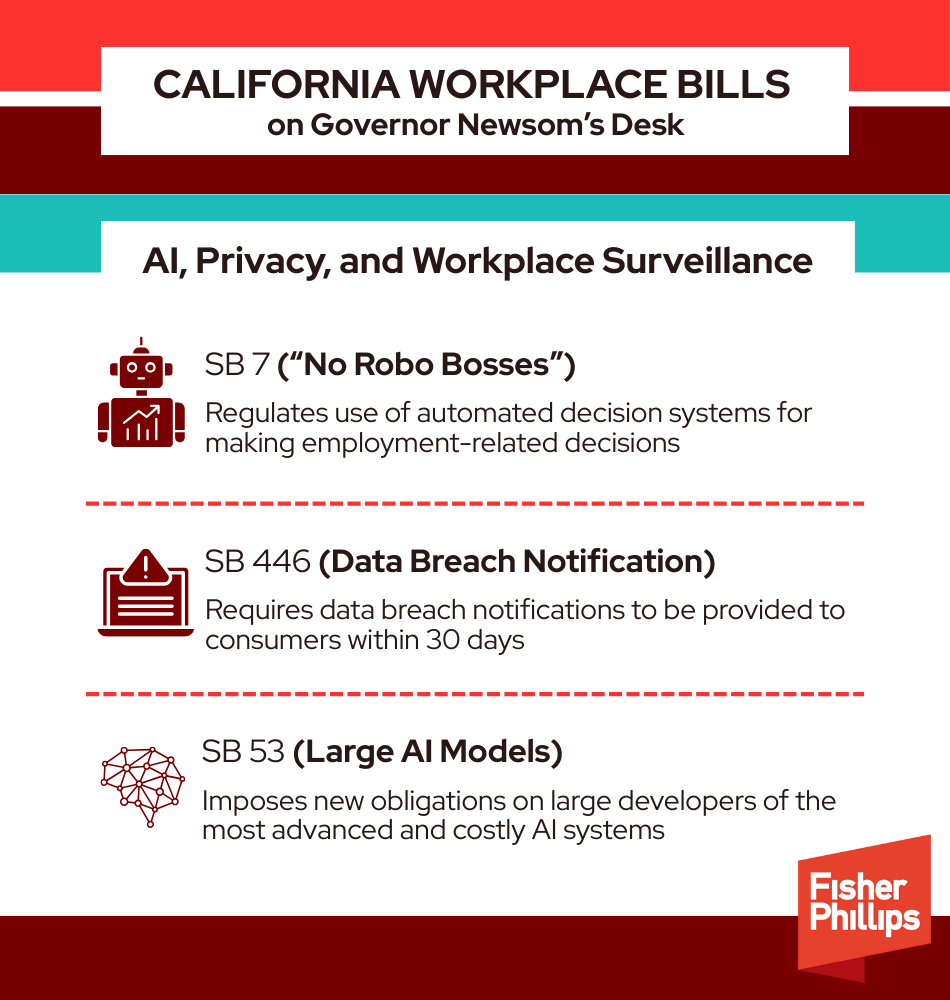

AI, Privacy, and Workplace Surveillance

The hottest topic for legislative discussion and action in 2025 continued to be artificial intelligence and related technology issues. AI alone accounted for the focus of more than three dozen bills considered this year, and California may soon join the growing list of states to enact their own laws related to the use of AI by businesses.

Several bills that would impact employers directly made it to Newsom’s desk and are now awaiting further action. These include:

- SB 7 (“No Robo Bosses”) – SB 7 is specific to employment-related decisions using AI technology and automated decision systems (ADS). This bill would require employers to provide certain notices regarding the use of ADS, prohibit employers from using ADS for certain purposes (including inferring a worker’s protected status under existing law), and require a human reviewer when an employer relies primarily on ADS to make a discipline, termination, or deactivation decision. For our full FP deep dive on SB 7, click here.

- SB 446 (Data Breach Notification) – This bill requires data breach notifications to be made within 30 days of discovery or notification of the data breach. To learn more, read our previous Insight here.

- SB 53 (Large AI Models) – This bill is a follow-up to last year’s SB 1047, which was vetoed by the governor. Among other things, SB 53 requires large developers of the most advanced and costly AI systems to implement certain protocols and make public disclosures of the protocols they use to mitigate the risk of catastrophic harms. The bill also provides for whistleblower protections and enforcement by the state’s attorney general. For our full FP deep dive on SB 53, click here.

|

Don’t forget that this has been a hot topic on the regulatory front as well. Earlier this year, the California Civil Rights Department adopted regulations regarding AI-based employment discrimination, which go into effect in October. And the California Privacy Protection Agency has pending regulations that would impose sweeping requirements related to automated decision-making systems starting in January. |

Other Notable Workplace Bills

- AB 1136 (Immigration and Work Authorization) – This bill was introduced in response to well-publicized federal immigration enforcement actions earlier this year. Among other things, the bill would require employers to provide workers with up to five unpaid days per year to attend to matters dealing with immigration status or work authorization. AB 1136 also requires employers to provide reinstatement rights (for up to two years) for employees who have been terminated due to lack of proper work authorization but subsequently produce it.

- SB 261 (Unsatisfied Wage Judgments) – This bill would create a civil penalty of up to three times the amount of any outstanding wage judgment that goes unsatisfied for 180 days after the time to file an appeal has lapsed.

- SB 464 (Pay Data Reporting) – This bill would make several changes to California’s existing pay data reporting law, including mandatory civil penalties for failures to comply with the reporting requirements and additional “job categories” that must be covered in pay data reports (increasing from 10 to 23 specified categories in 2027).

- SB 294 (Workplace Know Your Rights Act) – Also inspired by recent immigration enforcement action, this bill would establish a new workplace notice requirement advising workers about their rights under the law – including protection against unfair immigration-related practices and constitutional rights when interacting with law enforcement in the workplace. SB 294 would also require an employer (if requested by the employee) to notify their designated emergency contact in the event the employee is arrested or detained at work.

- SB 642 (Job Postings and Equal Pay) – This bill revisits California’s requirement to provide pay scales in job postings to specify that the pay scale listed must be made in “good faith.” The bill also makes significant changes to California’s Equal Pay Act, including extending the statute of limitations for pay discrimination claims to three years and allowing potential recovery of lost wages up to six years.

- AB 692 (Stay or Pay Provisions) – AB 692 attempts to prohibit certain “stay or pay” provisions in agreements with employees. Among other things, the bill makes it unlawful for any employment contract entered into after 2025 to include specified terms requiring a worker to pay an employer a debt if the worker’s employment or work relationship with that employer terminates, unless certain conditions are met. For our full FP deep dive on AB 692, click here.

- AB 1326 (Face Coverings) – AB 1326 – would provide that an individual has a right to wear a “health mask” in any public place (including an employment setting or other workplace).

- AB 858 (COVID Rehire Rights) – This legislation would extend a soon-to-expire law, which provides COVID rehire rights for certain hospitality and related workers, until January 1, 2027.

- SB 590 (Paid Family Leave) – This bill amends California’s Paid Family Leave law to allow employees to care for a seriously ill “designated person” – meaning any blood relative or individual who is the equivalent of family. This is similar to a change made to the California Family Rights Act several years ago.

2 Bills That Did Not Make It to the Governor’s Desk

These two bills would have significantly impacted employers but failed to pass:

- AB 1018 (Automated Decision Systems) – This bill, which is similar to legislation (AB 2930) that did not make it to the governor last year, sought to regulate the development and deployment of automated decision systems (ADS) used to make “consequential decisions,” including employment-related decisions. It would have required employers to provide employees and applicants with disclosures about AI-driven decisions (both before and after the decision is finalized) and give them an opportunity to appeal the outcome. In some circumstances, employers would also have been required to fulfill the additional obligations the bill imposed on ADS developers, such as conducting annual impact assessments of the covered ADS.

- AB 1331 (Workplace Surveillance) – This bill would have made some significant changes to the rules governing employers’ use of surveillance technology (defined very broadly) in the workplace. AB 1331 would have prohibited audio surveillance in employee break rooms and cafeterias – and would have allowed video surveillance in such areas only if certain conditions were met. The bill would have also entitled employees to leave behind workplace surveillance tools when entering employee break rooms and cafeterias and during off-duty hours. AB 1331 did contain certain exceptions for when surveillance is required by law and had a carve-out for employers that develop aircraft or products for national security, military, space or defense purposes.

Conclusion

We will continue to monitor each of these bills to see if they are approved or vetoed by Governor Newsom, and we’ll provide further analysis and compliance assistance for any bills that are enacted. Make sure you are subscribed to Fisher Phillips’ Insight System to get the most up-to-date information. In the meantime, for more information about these pieces of legislation, feel free to contact your Fisher Phillips attorney, the author of this Insight, or any attorney in our California offices.